Reasons for Buying More

Dividends are never guaranteed. Companies determine their dividend payout when the board of directors meets. But there is something about observing history that helps an investor know what is likely to happen. Sometimes the CEO of a company also shares the company’s intentions. Here is a quote from the president and CEO of Capital Southwest:

“While future dividend declarations are at the discretion of our board of directors, it is our intent to continue to distribute quarterly supplemental dividends for the foreseeable future while base rates remain materially above long-term historical averages and we have a meaningful UTI (undistributed taxable income) balance.” – President and CEO Bowen Diehl.

Does Your Advisor Invest Like He Recommends You Invest?

Although I am not an investment advisor, I want my readers to know that I don’t make recommendations that I am unwilling to follow. I eat my own cooking. I am not like the fast-food cook who won’t eat the fast food he cooks. If I cook it, I eat it.

The following image shows all of the CSWC activity in our accounts for 2023 YTD. As you can see, we received quarterly dividends at the end of March and the end of June. What is less obvious is that half of the dividends shown are supplemental dividends. In June, for example, I received a dividend of $810 in my traditional IRA. I also received a supplemental dividend of $75. The same is true for Cindie’s IRA, Cindie’s ROTH, and my ROTH.

If you compare the total dividends received in March with those we received in June, you may notice that there was an increase in the dividends received. During April and June I added 300 shares of CSWC. I did the same in mid-July and again on August 1, 2023. Of the 600 shares added YTD, 500 of the shares are in ROTH accounts. That means the dividend income on those share is tax-free.

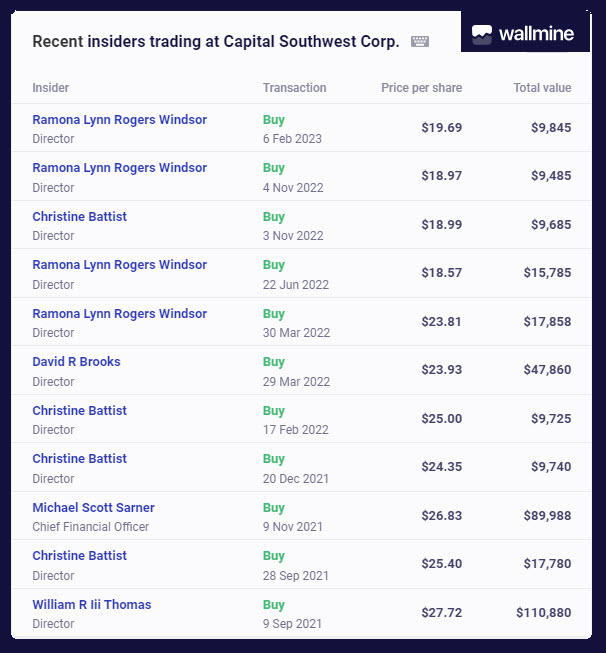

Wallmine, Stock Rover, Seeking Alpha, and Fidelity Investments

Wallmine is a quick way to check to see if company insiders are buying or selling shares. In the following image you can see that company directors have a history of buying shares. However, the dollar values are small, so this really isn’t a huge indicator of insider confidence. On the other hand, insiders are not selling. In fact, insiders paid more for the shares in the past than the current price of the CSWC shares. I believe this says something: the insiders are perfectly willing to continue to collect the dividends even if the share price fluctuates.

Stock Rover

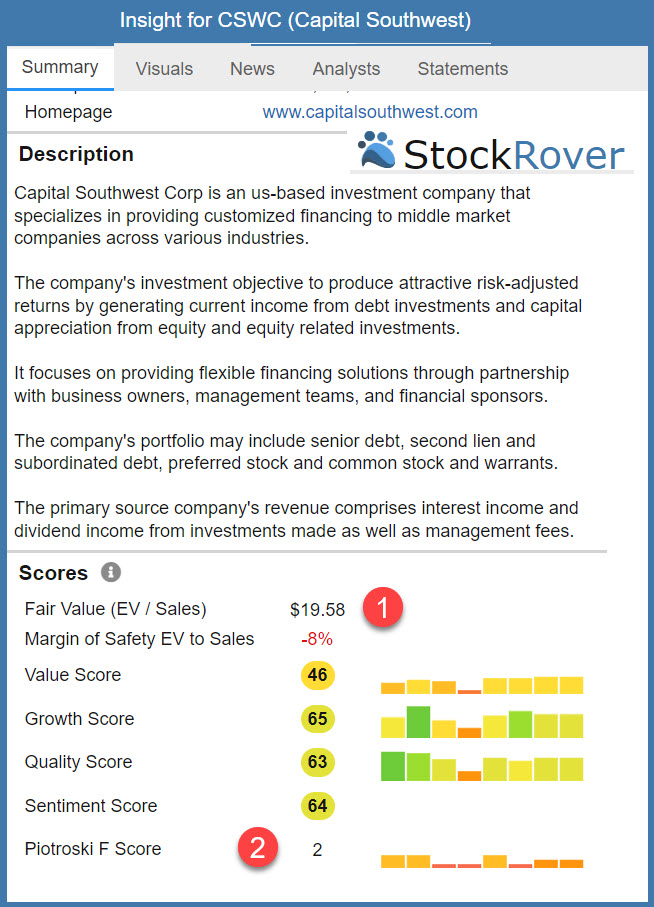

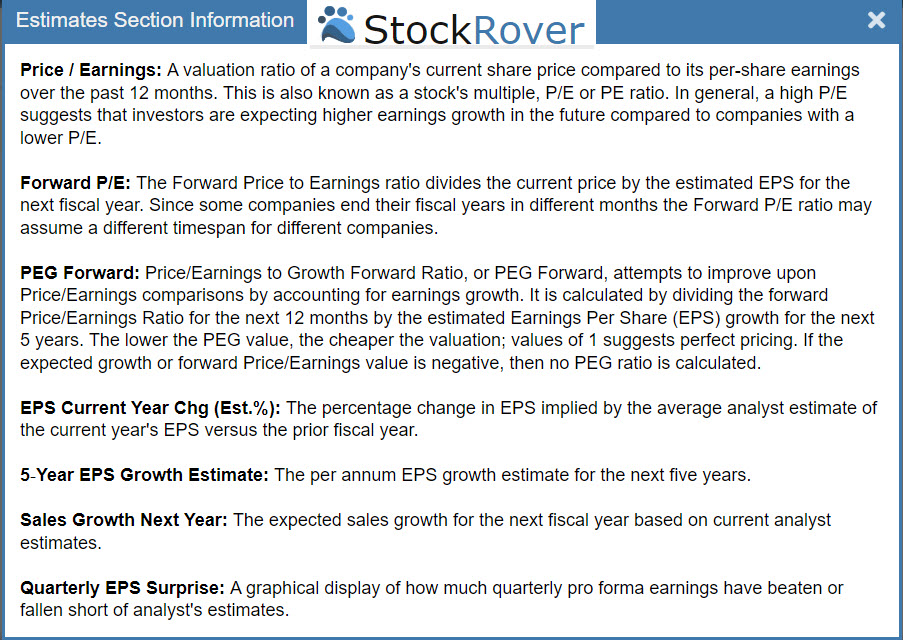

The Stock Rover images should cause most investors to pause and realize that CSWC is considered high risk. The scores don’t give many investors confidence. However, I think these scores are short-sighted. Many rankings, ratings, and scores have a big short-term bias. However, I share these images to present a caution for investors who cannot stand risk or volatility.

Fidelity Investments

If you are looking for comfort from Fidelity Investments, you won’t find it. The “Equity Summary Score” for CSWC is “Not available.” There aren’t enough analysts who rate this investment to give it a thumbs up or a thumbs down. However, the next earnings announcement date is next Monday, August 7. If earnings are wonderful, the price of the shares could shoot up. If they are anything else, they could drop. If they drop, I may buy more.

Seeking Alpha

So we see that the other resources aren’t as helpful as one might hope. However, I think Seeking Alpha presents some helpful data in visual form. There are three pieces I usually review. First of all, all of the sources for ratings say CSWC is a “Buy.” I am less concerned about an investment when multiple groups all think the investment has value at the current share price.

Secondly, “Earnings Per Share” (EPS) is headed in the right direction: up.

Thirdly, “Revenue” is also heading up.

If you are interested, here is the full “Company Profile” from Seeking Alpha. You can see that CSWC is in the Financial sector and their industry is “Asset Management and Custody Banks.” That is a fancy way of saying they loan money to companies after careful review of their business model, business prospects, and the potential for financial success and sustainability.

Recommendation

As always, just because Wayne buys something doesn’t mean you should. However, if you have $250K or more in retirement assets, then adding some BDCs can help round out your portfolio. Furthermore, if you have bonds in your portfolio that are paying 5%, you might want to sell some of them and replace them with CSWC shares that are paying 10%.

Full Disclosure

Cindie and I own substantial amounts of several different BDCs. In addition to CSWC we own shares of MAIN, ARCC, and OBDC, to name a few. I think BDCs are good long-term positions for dividends in retirement.