A Different Approach – Semiconductors

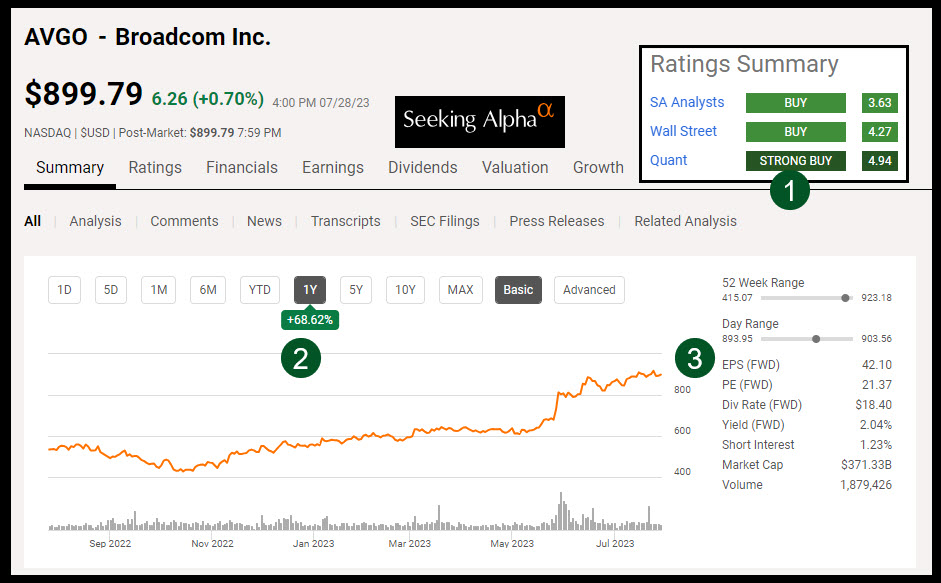

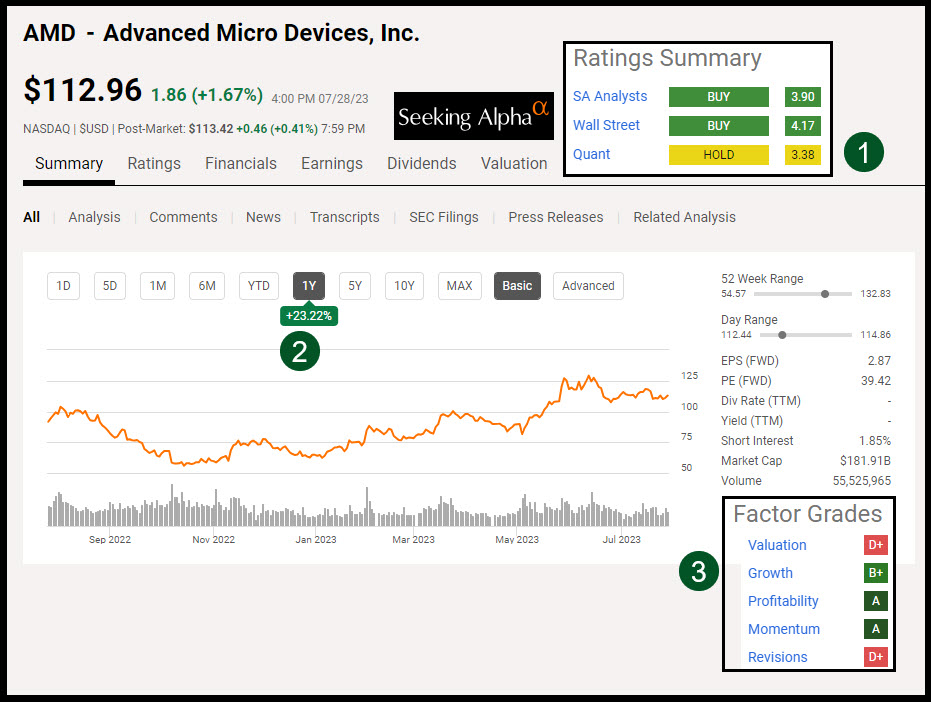

If you examine my top ten investments, it is easy to see that VYM and AVGO are the top two. There is, perhaps, a better way to look at these. Because I focus on dividends and dividend growth, it is easy to miss non-dividend stocks worthy of consideration. As it turns out, both AVGO, which pays a dividend, and AMD, which does not, are both in the Information Technology sector and both are in the Semiconductor industry. These are my number one holdings in each category of investment.

Costly Stocks Are Expensive?

A common mistake new investors make is to buy low-cost stocks. They think it is better to own 100 shares of a $5 stock than one share of a $500 stock. The investment dollars are the same, but there is some strange appeal to having 100 of something rather than just one. It is like asking a small child if they want five pennies or one dime. The pennies, if they are new, appear to be a better deal. The dime is “smaller” and perhaps less attractive. We do the same thing with other things in life, including how we invest.

Semiconductors Are Everywhere

It is a mistake to think something small is not valuable. Semiconductors have invaded so many products that we see the products but not the components. They are found in thousands of products such as computers, smartphones, appliances, gaming hardware, and medical equipment. According to Seeking Alpha, there are 68 companies that fit in this industry, and AVGO is rated number one in the list. AMD is number 18 out of 68.

According to Britannica, a semiconductor is “any of a class of crystalline solids intermediate in electrical conductivity between a conductor and an insulator. Semiconductors are employed in the manufacture of various kinds of electronic devices, including diodes, transistors, and integrated circuits. Such devices have found wide application because of their compactness, reliability, power efficiency, and low cost. As discrete components, they have found use in power devices, optical sensors, and light emitters, including solid-state lasers. They have a wide range of current- and voltage-handling capabilities and lend themselves to integration into complex but readily manufacturable microelectronic circuits. They are, and will be in the foreseeable future, the key elements for the majority of electronic systems, serving communications, signal processing, computing, and control applications in both the consumer and industrial markets.” (LINK)

AVGO and AMD

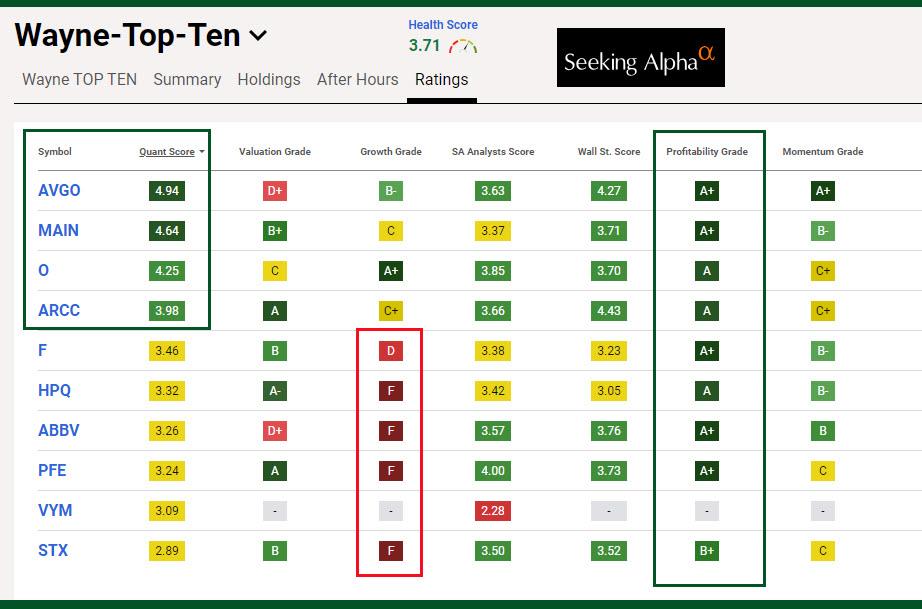

The following four images will tell you more about AVGO and AMD. If you want to invest in AVGO and you don’t have $89,000 to buy 100 shares, consider buying one share for $890.00. Then, if the price drops to $875, add a second share. That will be a far better investment than thousands of “low-cost” stocks you might consider.

Top Ten Dividend Investments

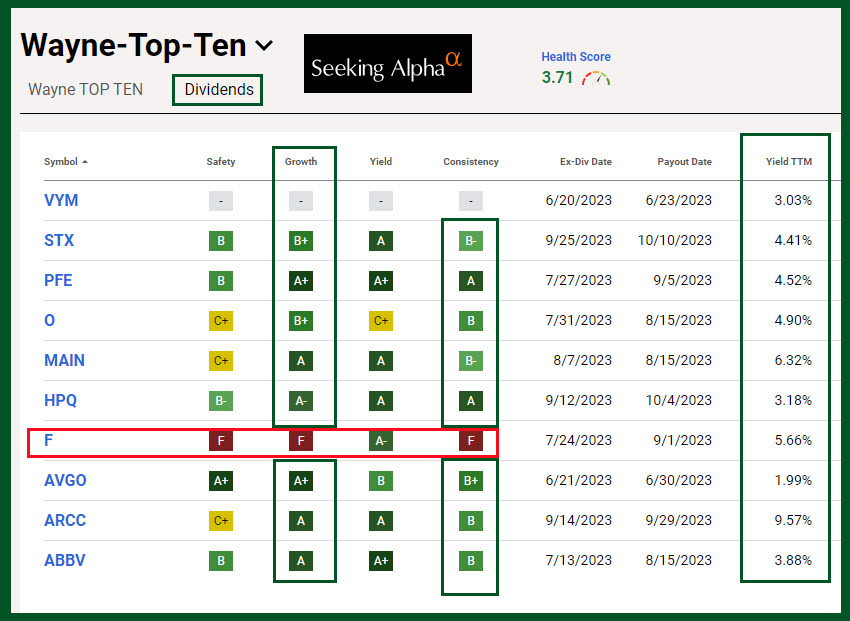

The top ten dividend-paying companies and ETFs in our total portfolio are shown in this illustration. Following it are a couple of other helpful views.

Top Ten Non-Dividend Investments

The top ten non-dividend companies in our total portfolio are shown here.

Slicing and Dicing Our Investments

The following three images illustrate the nature of our investments by allocation (97% stocks), sectors (notice the top three sectors), and geographical locations (92% USA). Another common flaw in the minds of many advisors and investors is that you have to have 10% or more of your investments in international companies. In a global economy, you have to remember that USA companies, for the most part, are international companies. This includes restaurants, transportation, utilities, technology companies, healthcare companies, and real estate companies. I would be so bold as to suggest that most investors don’t need international ETFs or mutual funds in their portfolio of investments.

Recommendation

You may want to use the Fidelity tools to examine your portfolio. Even if you only have ETFs and mutual funds, you can learn a lot about your portfolio’s focus on sectors and your allocation of your investment dollars to stocks, bonds, and cash. To find the tools, you may have to click on “More” and then “Analysis.” At that point you can select one account or specific accounts if you don’t want to include some accounts like UTMA accounts you manage for your children or grandchildren.