CD Ladders

If you have at least $4,000 in cash that you want to keep for future use, but you can afford to have some of it committed for 3, 6, 9, and 12 months, then a CD ladder is a good option. There is also a 2-year ladder and a 5-year ladder. You can also create your own 1-2-3-month ladder. The purpose of this post is to talk about ladders.

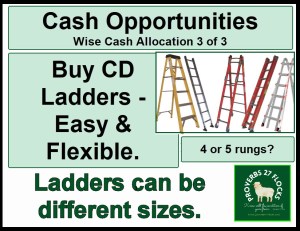

Before We Go There: Fixed Income Analysis

It might help to see how Fidelity provides “Fixed Income Analysis.” This image shows Cindie’s CDs. The maturity dates (1) and the yields (2) are displayed. Most of the CDs expire next month, and some expire in September and October. Only one is a bit farther out into January 2024. This display also shows a tax-free municipal bond (3) that I hold in a brokerage account. It is the only bond remaining of the ones I purchased when I thought bonds were a good idea.

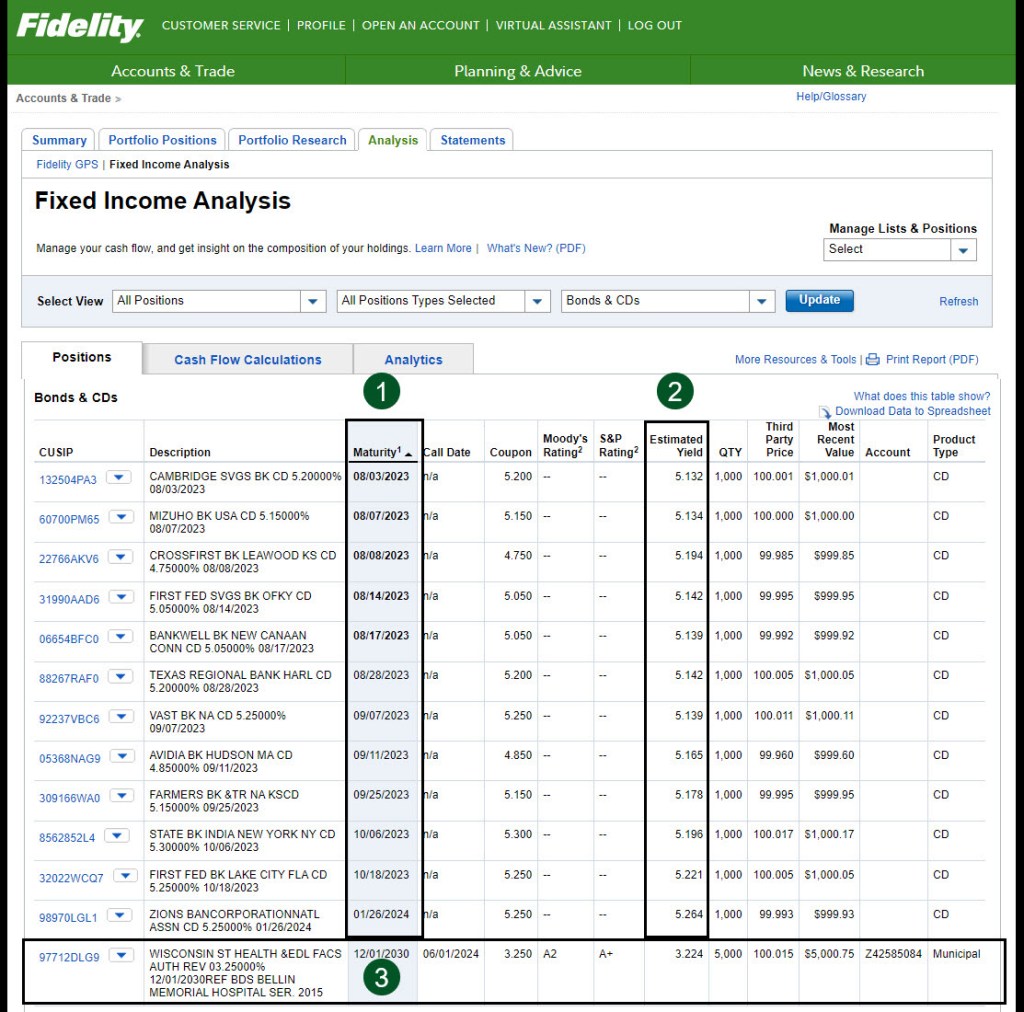

Cash Flow Calculations

Fidelity also makes it easy to see when you will receive your principal and interest. The following image shows that most of the money comes back in 2023. The total dollar amount invested in bonds (and CDs) is $17,000 (1). The average maturity is just a bit over two years, including the municipal bond (2) with an average estimated yield of about 4.6%. The annual interest is $206.99 (3). In each year, from the present until 2030, I am receiving tax-free income from the municipal bond. It will mature in 2030. I may or may not live to see that happen.

Fidelity’s Model CD Ladders

Fidelity displays three Model CD Ladders to educate investors with varying needs for liquidity and yield or return. Liquid just means how soon you need the cash for some purpose. So liquidity is the ease with which an asset, or stock, or CD, can be converted into ready cash without affecting its market price. You can sell a CD early, but if you paid $1,000 for it and it has a 12-month maturity, you might not find a buyer who will give you $1,000. Here are Fidelity’s prebuilt models:

1-Year Ladder: Composed of four maturity “rungs” – 3, 6, 9, and 12-month

2-Year Ladder: Composed of four maturity “rungs” – 6, 12, 18, and 24-month

5-year Ladder: Composed of five maturity “rungs” – 1,2,3,4, and 5-years to maturity

Steps to Buy a Prebuilt Ladder

- Choose a Model CD Ladder: 1-year, 2-year, or 5-year.

- Select the Fidelity account in which you want to build your Model CD ladder and enter the total amount you want to invest. If you are buying a 1-year or 2-year ladder, the minimum to buy the ladders is $4,000. For the 5-year ladder you will be investing $5,000.

- Choose whether you want the maturing positions in your CD Ladder to be returned to cash or use Auto Roll to automatically reinvest in new CDs at the end of the ladder. I think it is generally best to not use the auto roll feature when interest rates are rising. Furthermore, if you need the cash when the CD comes due, it is available for your needs.

- Review the results and edit as needed before you buy your ladder.

The following two images show the three prebuilt ladders and what a 1-year ladder looks like. The first is the screen you use to pick a ladders and the second illustrates the results of the choices you made. You can create a PDF Bond report from this screen.

Bond Report

The following four images show the bond report Fidelity provides for the interested investor. I especially like the fourth page, as it gives you a sense of how long your money will be invested and the estimated interest you will receive and when you will receive it.

Recommendation

If you have less than $4,000 to invest, then you should just pick individual CDs. If you want to save time and are satisfied with the prebuilt ladders, then those can save you some time in creating your CD order if you have $4,000 to invest.