I Think the Bears Are Wrong

As interest rates went up, and as office properties began to feel occupancy stress, the value of many REITs dropped. I would not buy an office REIT, but ABR is not in that crowd. I am convinced that our investment in ABR is a good long-term dividend growth easy income play.

A Dividend Increase Announcement

ABR announced another dividend increase. While it wasn’t huge, the increase adds $144 to our annual income. This is also sweet because we hold 1,100 shares in our ROTH IRAs, so $1,892 of the total income from this REIT will be tax-free if we choose to withdraw the dividends from our ROTH accounts.

Easy Income Strategy

The goal of easy income is to have increasing income that requires little or no effort. The beauty of a good REIT is that someone else deals with the day-to-day operations and problems with each property. The other thing I like is that a REIT can diversify in ways that I could not. A little investment in real estate requires a big purchase price. That isn’t the case with a REIT.

Company Profile Reveals Wonderful Diversification

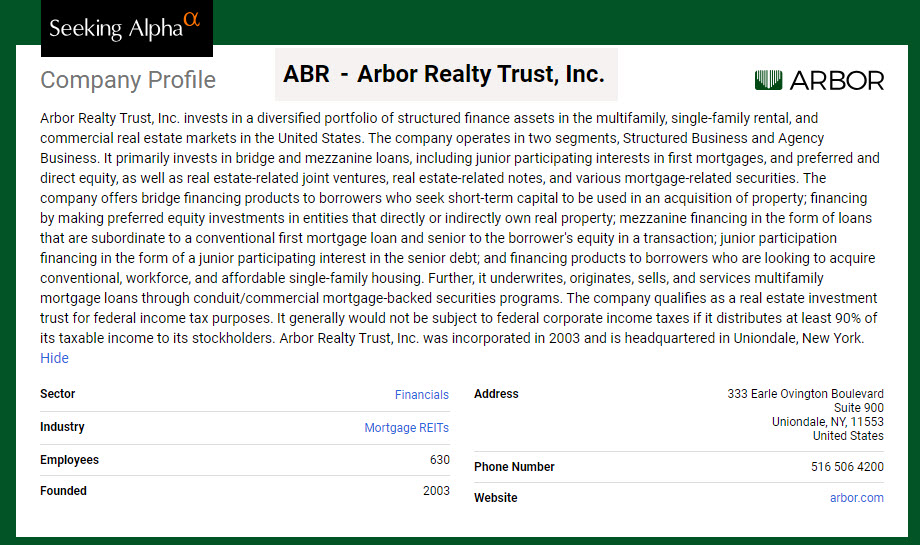

Arbor Realty Trust, Inc. invests in a diversified portfolio of structured finance assets in the multifamily, single-family rental, and commercial real estate markets in the United States. The company operates in two segments, Structured Business and Agency Business. It primarily invests in bridge and mezzanine loans, including junior participating interests in first mortgages, and preferred and direct equity, as well as real estate-related joint ventures, real estate-related notes, and various mortgage-related securities.

The company offers bridge financing products to borrowers who seek short-term capital to be used in an acquisition of property; financing by making preferred equity investments in entities that directly or indirectly own real property; mezzanine financing in the form of loans that are subordinate to a conventional first mortgage loan and senior to the borrower’s equity in a transaction; junior participation financing in the form of a junior participating interest in the senior debt; and financing products to borrowers who are looking to acquire conventional, workforce, and affordable single-family housing.

Further, it underwrites, originates, sells, and services multifamily mortgage loans through conduit/commercial mortgage-backed securities programs. The company qualifies as a real estate investment trust for federal income tax purposes. It generally would not be subject to federal corporate income taxes if it distributes at least 90% of its taxable income to its stockholders. Arbor Realty Trust, Inc. was incorporated in 2003 and is headquartered in Uniondale, New York.

Here are some images from Seeking Alpha.

Recommendation

As always, diversify your investments. If you are in retirement, it certainly doesn’t hurt to have investments that pay you monthly or quarterly. Those types of investments can help you stay the course when everyone else is selling because of the most recent bad news. Some good monthly REIT dividend investments include O, ADC, and STAG. ABR pays quarterly.

Full Disclosure

Cindie and I own a combined total of 3,600 shares of ABR in our IRA and ROTH accounts. These shares are worth over $58,000. You cannot buy a sliver of real estate for that price.