Wise Cash Allocation 2 of 3

Some Important CD Fundamentals

I have been helping our nephew Joe think about his business and how he might want to make some changes. I also have been encouraging him to move his cash to Fidelity and fund his ROTH IRA for 2023. I’m encouraged to see that he is taking my advice. I’m also traveling to Montana in August to spend some time with him and give him some more training.

Our nephew Joe asked the following question in a recent email message to me: “I’m also wondering what would be a good investment for me to place my brokerage funds in? Keeping in mind I may need some of the funds for taxes at the end of year. The money I’m trying to build up in the brokerage account will hopefully be used for a down payment on a home, or newer vehicle someday if needed. Or worst-case scenario, it might be used for an emergency that exceeds my available funds in other accounts.”

My Recommendation to Joe was…

For your brokerage account, I recommend buying CDs. Buy short-term CDs that will come due by the time you have to pay income taxes. For your Aunt Cindie, I buy her 1, 2, and 3-month CDs, so every month when one $1,000 CD expires, I buy a replacement. At the moment she owns twelve $1,000 CDs.

I would not buy stocks for cash that is needed in the next 6-12 months. If you buy a 1-month CD, you will get the interest in one month. If you buy a 2-month CD, they will usually pay the entire interest at the end of the two months. Sometimes you can find 3-month CDs that pays monthly interest.

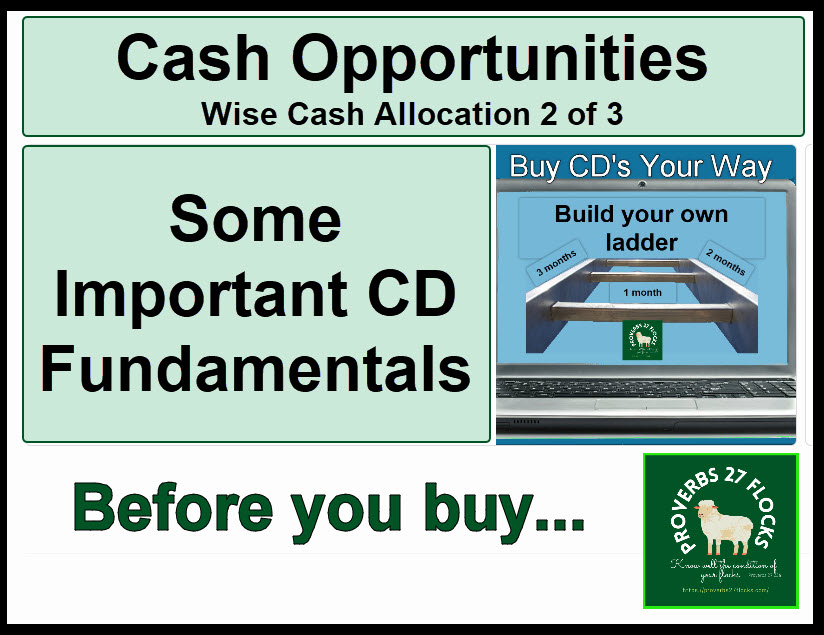

When buying CDs, note if they have an attribute named “SKY”. When you click on SKY for a CD (in this example), you can see that anyone who lives in AR cannot purchase this CD. This CD pays the interest monthly. In general, it is nice to get the interest early.

Which Fidelity Accounts Can Have CDs?

We all keep cash for various reasons. In our case, because we have to take RMDs (Required Minimum Distributions) in 2024, I don’t want to have our cash balances too low. While it is true that dividends can easily cover the RMD’s for my traditional IRA, I don’t want to have to lean on the dividends for the RMD. I may want to reinvest most of those. At the present time, only Cindie’s traditional IRA has CDs. However, you can buy CDs in the Fidelity Cash Management Account, a ROTH IRA, or a brokerage account.

Why Avoid the Banks?

To illustrate the folly of investing your cash in CDs at a brick-and-mortar bank, consider the following CD rates from Wisconsin Bank and Trust. This is just about as close to robbery as a bank can get. To pay a depositor 0.01% for a three-month commitment of $1,000 is just silly.

The rates on the 2, 3, and 4-year CDs are worse than ridiculous. Only the 11-month CD, which requires “new money” is worthy of any consideration. However, the one-year CD at Fidelity offered by JP Morgan Chase is 5.50%. So accepting 4.75% for eleven months makes no sense to me. In fact, Fidelity currently offers a ten-month CD from Associated Bank that pays 5.3%. Granted, if all you have is $1,000, the total dollars of interest won’t matter too much. To me it is the principle of the thing.

Selecting Individual CDs

Because I prefer to pick the “Period” or duration of the CD, I scroll down on the “Fixed Income, Bonds & CDs” page to see the tab that is labeled “CDs & Ladders.” The best yield for new CDs at the time I wrote this is 5.5%. This rate is available for 1-year and 5-year CDs. However, by clicking on “CDs & Ladders” I can see each individual CD that is offered. The shortest duration is one month, followed by choices for increasingly longer durations. Although the yield for the shorter duration CDs is less than 5.5%, there are many choices for rates at or above 5.0%.

New Issue CDs at Fidelity

In the following illustration you can learn a lot about CDs. (2) The “Coupon” is essentially the yield of the CD. So a coupon of 5.000 is the same as 5%. The “Maturity Date” (3) tells you when you can expect to receive your principle back with interest. If a CD is “Call Protected” then there is very little likelihood that the bank will choose to give you your CD principle back before the maturity date. The “Settlement Date” (5) tells you when the cash will be withdrawn from your core account. In the first row, the Beal Bank CD will settle on August 2. So if you place an order before that date, you can expect it to be filled no later than August 2.

The “Quantity Available” is a way to know if the remaining CD inventory is sufficient for your needs. If there are only 103 CDs remaining, and you enter an order at the same time as another 120 investors, only 103 of the investors will receive the CD. This assumes everyone only wants one CD. Some might want ten units ($10,000) of that CD. The others who come late will have to pick another investment.

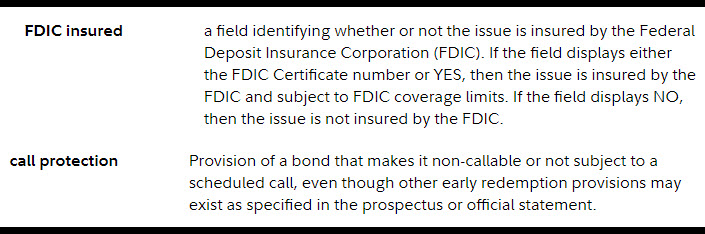

“Attributes” (6) is another important column. You will notice that all of the CDs offered on the Fidelity website are FDIC-insured, and most are Call Protected. “SO” means Survivor Option. SO, also known as a “death put,” a feature of certain debt instruments allowing for the estate of a deceased investor to “put back” or redeem both principal and interest of that instrument without penalty. If you buy a one-year CD and die six months after purchase, your estate can redeem the bond without penalties.

“SKY” is probably the most important flag to notice. There are some CDs that cannot be purchased in some states. “The registration of new issue securities with the state agency that reviews selling documents for accuracy and completeness. When seen as an attribute (“SKY”) in a CD Results table or Details page, the phrase is used to point out those states that have Blue Sky Laws that prohibit the marketing and sale of that security to customers residing in that state.” – SOURCE: Fidelity Investments. In this example, the BANK OZK CD is not available for residents of Arkansas.

Finally, (7) is the “Period.” In general, I prefer CDs with a period of less than six months. Anything longer doesn’t appeal to me and may tie up the cash for too long. If you are convinced that you won’t need the cash for twelve months, then a 12-month period might just be fine for you.

The “Coupon Frequency” column tells you when you can expect to receive the interest. For many of the CDs it will be “At maturity.” However, there are some CDs, like the BANK OZK 3-Month CD that pay monthly.

CD Ladders

A CD Ladder is a quick way to buy four CDs (or five for a 5-year ladder) with different periods. However, to be able to use this you need to have at least $4,000 or multiples thereof, to get four $1,000 CDs. In my next post I will finish this series with some thoughts about CD ladders.

“Model CD Ladders provide an easy way to invest in multiple Certificates of Deposit (CDs) at a time, blending longer-term CDs with shorter-term CDs. By selecting one of the three models shown below you can easily filter our new issue CD inventory using a set of objective screening criteria to model your own CD Ladder.” – SOURCE: Fidelity Investments

Recommendation

Take a look at your bank or credit union statement. Do you like what you receive in interest? Are the CDs that your provider offers available in 1-month, 2-month, and 3-month durations paying at least 5%? Will they let you buy CD ladders using their website? If not, then you may want to consider taking the time to move to a better solution. Yes, I know there is some work involved, but your money should be working as hard as you do.

Sinking Fund Protection

I wouldn’t worry about this attribute for CDs. If you are interested, here are some details.