In Five Minutes or Less

Some people are news junkies. They cannot seem to get enough of it. I’m of the opinion that a small dose can be useful, but I don’t need an intravenous injection of news. I like just a taste on the tip of my tongue like an Altoids curiously strong mint. There are three primary sources I prefer for news. The first one is a combination of the Wall Street Journal and Barron’s. The second is The Epoch Times. The third is the news feed on Fidelity Investments. I can handle all three in about five minutes each morning.

My primary reason for why I read the investment-focused news is to be ready to act on potential investing opportunities. Earnings announcements, boycotts, major government interference in commerce, and the activities of the Federal Reserve all come to mind. Of course, there are also jobless claims changes, personal income, and spending updates from the Commerce Department, and estimates about GDP. There are merger announcements or similar events that can drive the price of a company’s shares up in an irrational manner.

In my experience, many traders are a fickle, unpredictable bunch. As a result, the short-term news can cause a bounce higher and then the rally fizzles. I frequently see this in speculative investments, but it also happens in the dividend growth stocks we hold. This can also impact the major indexes, many of which hold the same top ten assets.

How I Read the WSJ News

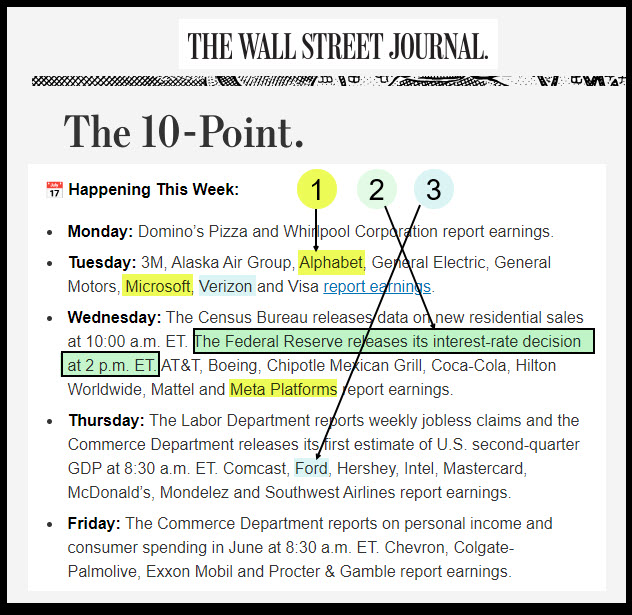

The following image helps illustrate how I read the news. Every morning I receive an email from the WSJ that is “The Ten-Point.” I don’t have the time or interest to read the entire journal, even though I could if I wanted to consume more news. The ten point distills the key suggested news or events of the week. In the following illustration I highlighted three that caught my eye: Yellow, Green, and Blue.

The Yellow

Alphabet, Microsoft, and Meta Platforms (Facebook) all report earnings this week. Investors may be delighted, ambivalent, or decidedly pessimistic when the earnings reports come out. While this can matter for all investments, bear in mind that these are three of the largest large-cap stocks. Bad news could send the S&P 500 and other indexes heavy in these investments on a dive. Good news could propel the market higher. Either way, there can be buying and selling opportunities.

The Blue

Ford and Verizon are in blue because I own shares of both of them. Verizon reports today and on Thursday Ford will report. Our grandson George also has a share of Hershey, so I could have made that one blue too. Although I don’t plan to buy more shares of Ford or Verizon, I want to look for opportunities to sell covered call options on positions like these if they shoot up 4-5% in a single day. Options traders watch for trends, even short-term trends, to determine if there is potential to earn some dollars on the excitement or the fear.

The Green

The Federal Reserve releases its next interest rate decision at 2 PM tomorrow. If they do something unexpected, like not increasing interest rates or lowering the rates (very unlikely) the market may shoot up or down due to increasing optimism or increasing pessimism about the future cost of money.

Other news items of lesser interest to me are the jobless claims and the estimate of the second quarter GDP. However, investors do respond to these types of news.

The Epoch Times

I grew weary of the biased opinion-saturated mainstream media channels. I don’t care for ABC, NBC, CBS, or Fox News. There are many other sources, but most of them are a waste of my time. Of course, I know that even Epoch has a bias, but at least I don’t feel like they are trying to sell me on a position.

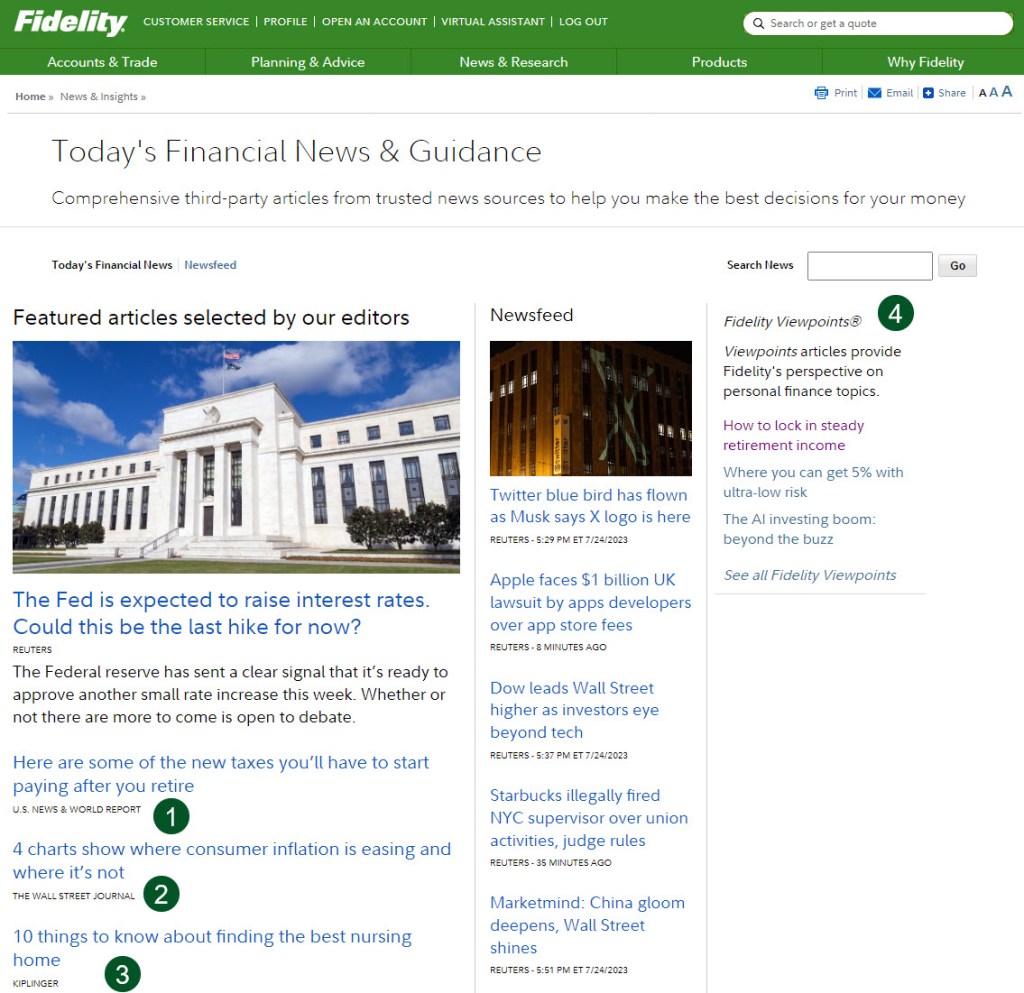

Fidelity Investments News

Another quick way to get news is on Fidelity. One of the benefits is that they have news and articles selected from other sources like U.S. News & World Report, Reuters, The Wall Street Journal, and Kiplinger. Some of these can be helpful depending on your life and upcoming events, like retirement. I also like some of the Fidelity Viewpoints. You can see that I clicked on “How to Lock in Steady Retirement Income.” The idea is to continue to learn and be alert.

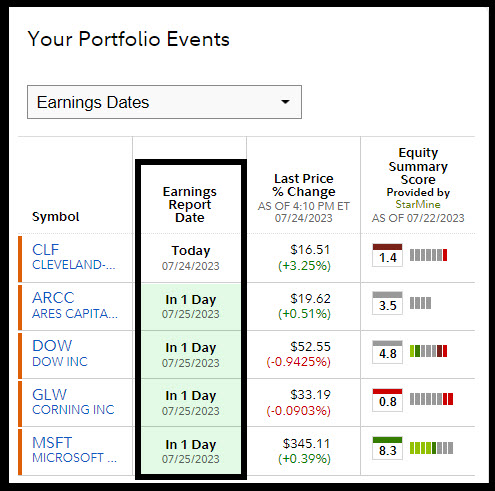

I also glance at the news related to our investments. Here is an example.

“What Is Gross Domestic Product (GDP)?

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health.” – Source: Investopedia

How do you see Portfolio Events at Fidelity?

Pete

LikeLiked by 1 person

If you go to the Summary page, there will be a panel that shows this information. There is a “Customize” function that allows you to move these panels around. However, if you scroll down on the Summary page you should see it. Note that I am using the “Classic Experience.” If you are using their “new” and “improved” version that might be different. I don’t like their new version so I am avoiding it as long as I can. 🙂

Another way to get information like this on all of your positions is by using Fidelity’s Active Trader Pro. A download of your positions from that software will show you all of the earnings and dividends dates for all of your positions. Those can be sorted in Excel, if you are comfortable with using Excel.

LikeLike