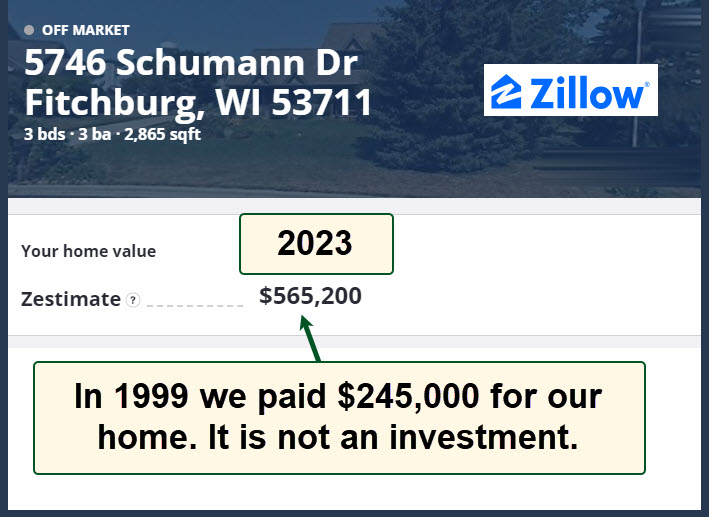

One Property is Our Home

I think it is erroneous for most people to consider their home an investment. It is an asset, but that asset value is usually reduced by the mortgage. Our home is mortgage-free now, so, according to Zillow, our home is worth $565,200. We paid $245,000 for this property in 1999, so it is worth more than we paid for it.

The problem with that thinking is that it certainly doesn’t include inflation, nor does it include all of the repairs, mortgage interest payments, and improvements we have made in the last 24 years. It also doesn’t include the cost of property taxes or property insurance. If we were to do the math, we might break even. We need some place to live, especially during Wisconsin winters, so our home cannot be partially sold like an investment in REIT shares.

The other problem with that thinking is that this property does not produce income. Anyone who thinks their primary residence is an investment is probably overlooking some of the realities of home ownership. There are, of course, exceptions. However, if you do the math, you won’t like the ROI for your home.

Update From One Month Ago

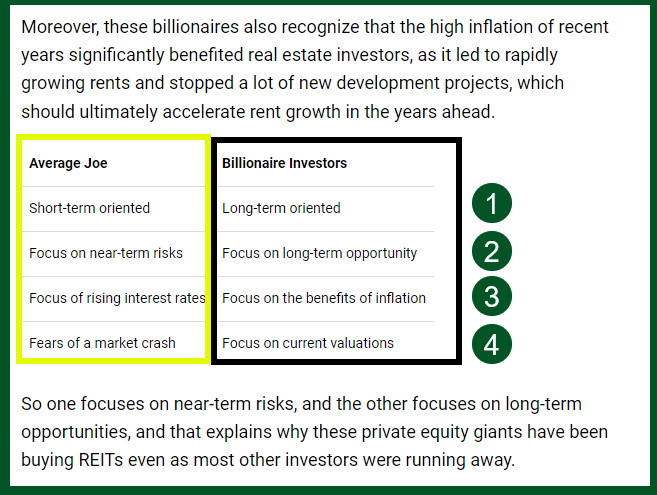

According to a blog post I did on June 12, 2023, our total real estate investment holdings were worth $396,891. In one short month, those same investments are now valued at $419,192.50. Therefore, if I were to sell today, then I would bank an additional $22,301.50. It does not make sense to sell the REITs, as I believe they will continue to increase in value. Not only that, but they are also continuing to produce monthly and quarterly income. One Seeking Alpha author suggests that now may be the right time to buy real estate. Here are three images from his post.

As you can see, his hypothesis is that we should (perhaps) follow the money. If billionaires are investing in real estate, then it can make sense to consider REITs. Furthermore, it makes sense to buy real estate if you are a long-term investor. I like the way he compares the “Average Joe” with the “Billionaire Investors.” Billionaire investors are not typically day-traders, and they don’t let the market’s gyrations dictate their behaviors.

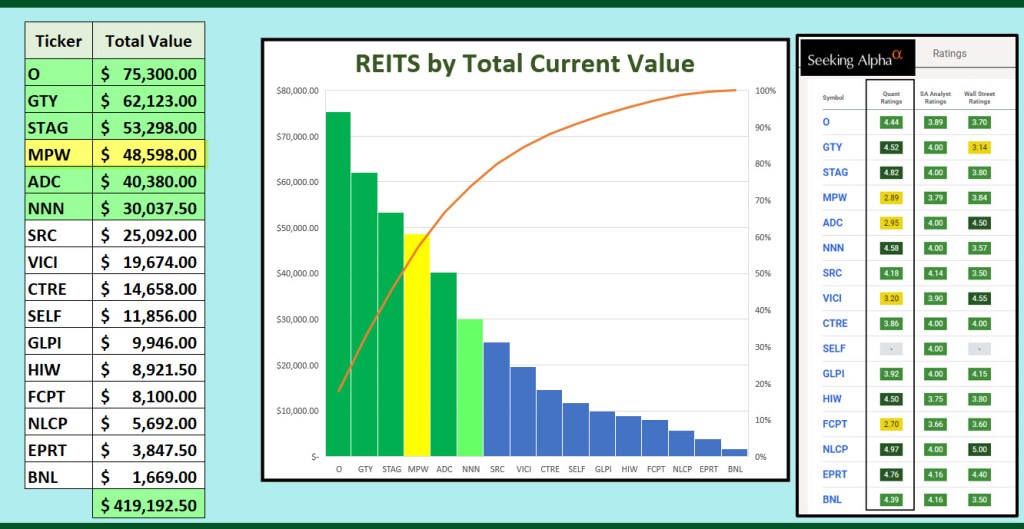

Revisiting Our REITs

If we compare the total value of our home with the total value of our REIT investments, it is easy to see that our home is “worth more than” our REIT holdings. Our REIT holdings currently have an average dividend yield of 5.8%. One can argue that I might be better off selling the REITs and buying short-term FDIC-insured CD’s. If I was a nervous investor, that would make sense. However, a CD that is worth $1,000 today will probably be worth less than $1,000 next month. The potential for an increase in the value of our REIT investments is far greater.

REITs Sorted by Value

This is a total of all of the REITs in all accounts. I used an Excel Pivot Table to produce this view. I also added the QUANT ratings from Seeking Alpha. I plan to buy more shares of NNN.

REITs Sorted by Annual Estimated Income

Again, this is a total from all accounts by ticker symbol. My caution is that you might want to hesitate before buying MPW. There are still some concerns related to their hospital holdings. However, I am willing to risk around 10% of our total REIT investment in MPW.

Full Disclosure and Suggestions

The REITs listed in our accounts are as follows: O, GTY, STAG, MPW, ADC, NNN, SRC, VICI, CTRE, SELF, GLPI, HIW, FCPT, NLCP, EPRT, and BNL. Of these, I suggest the beginner select the following: O, GTY, STAG, and NNN.

Seeking Alpha Link for Billionaire Investors Have Been Rushing to Buy REITs

Hi,

<

div>Thank you for your interesting artic

LikeLiked by 1 person