Analysis Using Fidelity Investments or Seeking Alpha

I have not found Fidelity to have useful portfolio analysis tools for the most part. However, there are aspects of the Fidelity tools that are helpful for a high-level view of a single account or of multiple accounts. To help my readers see the value of using both websites, I will give you a quick look at how I would analyze my ROTH IRA. My regular readers know that I have a dividend focus, with a strong preference for dividend growth and a bent towards BDCs and REITs. That is part of my Easy Income Strategy. First, I want to talk about Fidelity’s tools and how I use them to look at our investments.

The Fidelity Investments Views

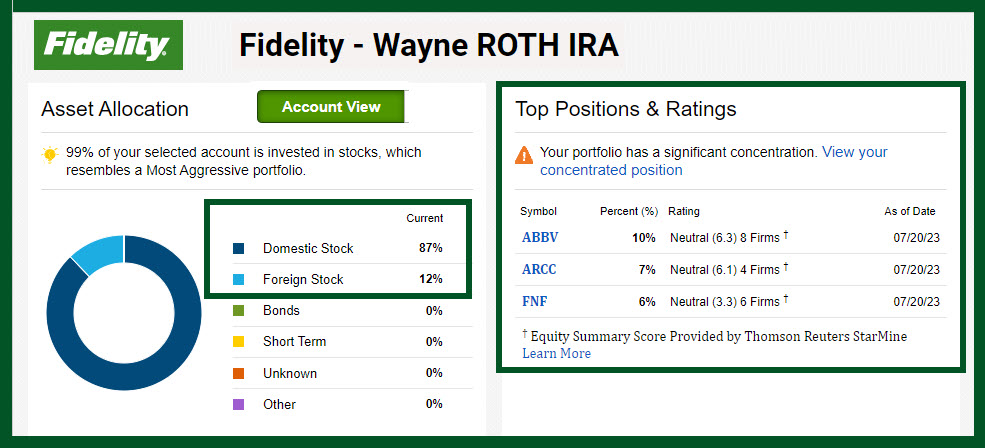

The first view does a nice job of showing the allocation of assets in stocks, bonds, cash (short term), and unknown/other. As you can see, my ROTH IRA has a very strong focus on stocks, with 99% of the holdings in that asset type. Fidelity says this is “Most Aggressive.” Yes, but I beg to differ. I would classify it as “More Focused.”

Fidelity also helps me see the top three positions in my ROTH IRA. As you can see, the top three are ABBV, ARCC, and FNF. The first is a health care stock, the second is a BDC, and the third is a property and casualty insurance financial stock. However, I don’t especially care for the Fidelity ratings, so although the ratings are “Neutral”, I am not concerned. Furthermore, I wish Fidelity would show at least the top five holdings, not just the top three. In their defense, most investors are not as diversified as I am.

Fidelity ROTH By Style

Another helpful view is the “Style” analysis. As you can see in the following screenshot, I am a “Medium Value” investor in my ROTH IRA. This means that I tend to prefer more of an allocation in mid-cap and small-cap stocks. However, you can see that I actually have 35% of my investments in small-cap stocks and only 23% in mid-cap. Notice how I compare with the Dow Jones U.S. Total Market Index. I clearly have a higher tolerance for more risk and potential market volatility. However, it can be shown that mid-cap and small-cap investments have a greater potential for long-term growth. This assumes, of course, that the right stocks and ETFs are in the mix.

Seeking Alpha Subscription

I recently “upgraded” my Seeking Alpha subscription to a three-year commitment. That was an offer I took because it reduced my annual cost for the subscription. The annual subscription, with tax, cost me $252.15. That was well worth the cost, in my opinion. I easily save that much and more in avoiding bad investments and in finding good ones. The new 3-year cost will be $499 plus tax, bringing the cost to $526.45 for three years, or $175.48 per year.

Seeking Alpha ROTH IRA By Value

Because I connected our Fidelity accounts to Seeking Alpha, I can see much more information about our investments in a much more user-friendly presentation. In the following image (with some editing for the purposes of this blog post), I have sorted the positions in my ROTH IRA by Value, and then numbered them so that you can see the Top Five and the Top Ten.

The two ETFs in the top ten are SCHD and VYM. DGRO is in fourteenth place in the ROTH, but not in all accounts combined. For a reader who knows the ticker symbols, you should notice that my largest investment is in health care, but I also have heavy allocations in the Financial sector that, when combined, are greater than the two healthcare positions (ABBV and PFE). There are three BDCs in my top ten: ARCC, MAIN and CSWC. It should be obvious that this is more helpful than what Fidelity presented on their website.

Seeking Alpha ROTH IRA Dividend View

Because I focus dividends, it is helpful to see which positions are going to contribute to dividend growth. It seems likely that ABBV, FNF, STAG, PFE, GTY, and CVX have the most years of dividend growth. It is also helpful to see the QUANT Ratings. If I saw a red QUANT in any of the positions, I would take a closer look to see what might be driving that.

This view also helps me see my dividend yields. In the case of my ROTH IRA, the yields on the stocks and ETFs in this view range from EOG’s 2.63% to CSWC’s 9.97%. However, it would be a mistake to think that I would be better off with more CSWC just to get the yield. Always think “sustainable dividend” and “diversification” when you add investments to your portfolio.

Buying Non-Dividend Investments

You might rightly ask, “Why don’t you have more growth investments in your ROTH IRA? The reason is simple: I want the dividends for various tax-free cash withdrawals for charitable giving or for projects Cindie and I want to complete. I don’t want to speculate quite as much in my ROTH IRA.

However, my traditional IRA has a much more aggressive approach. For example, I have shares of AMD, TSLA, and CCRN in my traditional IRA. My top five holdings in that IRA are AVGO, VYM, HPQ, STX, and F. However, AMD and TSLA are in the top ten. I can use both of those positions to do some significant covered call option trades.

Summary

I hope this helps you see the value of using Seeking Alpha to keep an eye on your investments and to find new investments that fit your investing strategy and needs. I believe Seeking Alpha is well worth the subscription cost.

Full Disclosure

This post does not represent the true top ten across all accounts. AVGO and VYM are actually the top two holdings in my Traditional IRA and those positions are much larger than the ones in my ROTH IRA.