Easy Income Worked While I Refocused

I don’t invest like most investors or advisors. I use and recommend a different approach. So at the close of the second quarter it is only fair for you to ask me to do a report card on my own retirement investment income. That is the purpose of today’s EIS update. This will be a two-part series. There are many ways to evaluate the performance of an investment strategy. I think a little historical view of the last 20 years of my retirement investment performance is a good place to start.

Examples of Performance Evaluation

Let’s examine two of many. The first compares your performance to that of a major index. The second will look at the retiree’s perspective and “performance” for income.

Comparing to an Index

Some like to compare their performance to an index. So, for example, it is not unusual for mutual fund managers to tout their success by comparing their results to the S&P 500 index. This can be a helpful way to see if you might be better off with their fund management or just by buying shares of SPY (SPDR® S&P 500 ETF Trust.) You could also buy shares of IVV (iShares Core S&P 500 ETF) or VOO (Vanguard S&P 500 ETF.)

The problem with that solution is at least two-fold, in my opinion. 1) When the stock market is bullish, the top ten investments in the S&P 500 are likely to do very well. Because the top ten investments make up 30% of the S&P 500 investors in these funds will do very well. However, the reverse is also true. If the bear market attacks, the downdraft can be very painful.

2) The second “problem” is related to income in retirement. The dividend yield on all three of these is tied to the yield of the S&P 500. For VOO, SPY, and IVV, the Dividend Yield (TTM) for each is around 1.50%. If you have a $2 million dollar portfolio of VOO, your annual dividend income will be $30,000. If you need more income, and you have no other sources of income, then you have to sell shares of VOO or get a job.

Most people don’t have a two-million-dollar portfolio. In my discussions with investors, it would seem most have less than $500,000. If you invest $500K in the S&P index funds, your annualized dividend income will be about $7,500.

Comparing Funds (and Stocks) Based on Income and Income Potential

Another way to evaluate success is by using different metrics. I prefer to be more focused on dividend growth. VOO has a decent 5-year dividend growth of 6.16%. But I have other investments, like SCHD, DGRO, and VYM that outpace VOO. DGRO’s 5-year growth rate is 10.64%, VYM has a 5-year growth rate of 6.08% (and a better yield of 3.13%), and SCHD stands at 13.92% and a remarkable yield of 3.54%.

Therefore, if I have $500,000 invested in SCHD, my income will be $17,700 – more than twice that of VOO. Furthermore, using the past five years of history, it seems very likely that SCHD’s dividend income will also grow faster than VOO’s. VOO’s dividend growth rate has been 6.16%. SCHD’s is 13.92% Your $7,500 income will grow more slowly than your $17,700 income, assuming there are no major disruptions in the stock market and in the flow of dividends.

My Experience with Dividend Growth

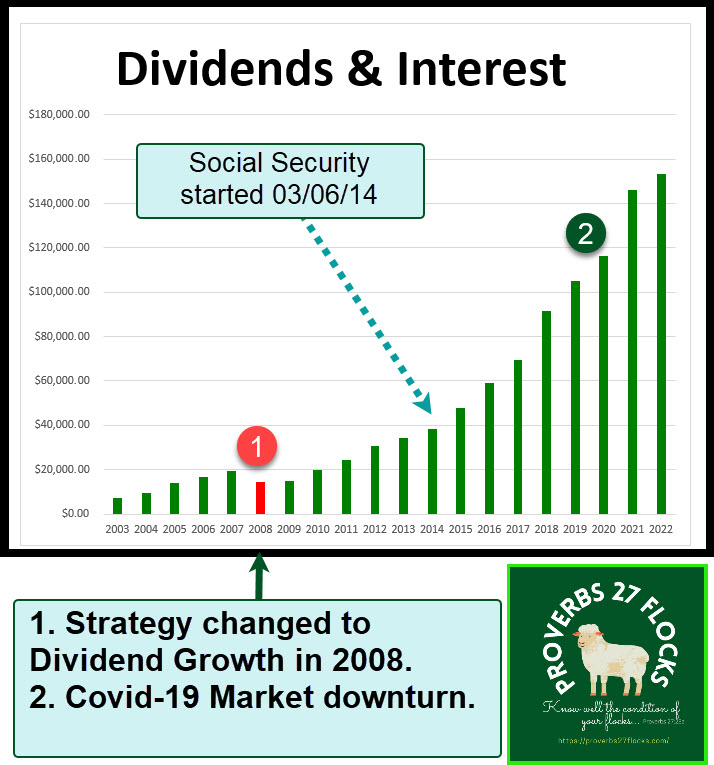

It isn’t a blind leap of faith to use the dividend growth model for retirement. Even during bear markets, and during the Covid-19 market plummet, our dividends continued to arrive.

The best way to illustrate this is using a tool provided by Fidelity Investments. There is a PERFORMANCE tab on Fidelity, and this can be used to see “BALANCE AND PERFORMANCE ACTIVITY” in different time frames and by monthly, quarterly, or annual views. This is a good way to measure performance. Of course, this only works if all of your investment accounts are with Fidelity Investments. Otherwise the work to do the analysis can be cumbersome, if not just mind-numbing.

This image shows the growth in dividends for the past twenty years. Understand that I took a hard look at my investment strategy in 2008 and decided to change the model. I started to remove bonds and began to focus on dividend growth stocks. Over time I reduced my individual stocks and started to grow positions in VYM, SCHD, and DGRO.

This next image shows the actual numbers. I think this is helpful, as it shows the percentage growth of the total dividends we received. Using the mix of investments we have (which includes stocks that don’t pay a dividend) it is not unusual to have dividend growth of at least 10% year-over-year. Remember inflation? If your only income is Social Security, you will face some painful decisions if inflation is even 3%.

We have Social Security income, interest income, dividend income, and even some income from trading covered call options and cash covered put options. That will be included in more detail in the next 2023 Q2 review post.

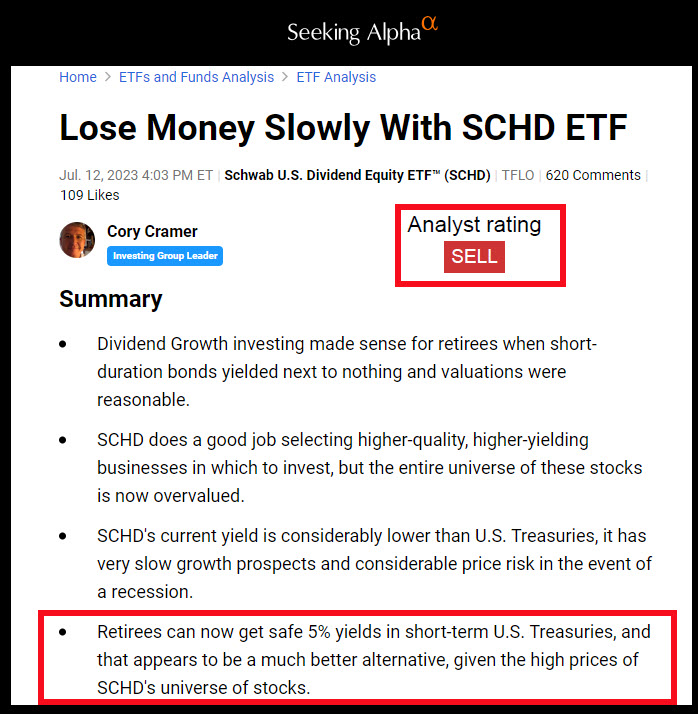

An Opposing Viewpoint

One Seeking Alpha contributor would argue that SCHD is not a good choice. He would suggest fixed income investments like short-term US Treasuries. I can see why he might think that. He says, “The first thing investors need to understand is that the stock market is a parimutuel system, which is similar to betting on a horse race. Investors are rewarded by being both correct and contrarian. If everyone bets on the most popular horse in a race, even if they are correct, they would simply be returned their money (minus any fees or house take). In order to make the most money, you need to be correct about the winner and also have some other people choose a different horse. The less popular your horse is when they win, the more money you make.”

One problem with his comparison is that the stock market really isn’t much like betting on a horse race. It is rare to lose every dollar you invest in the stock market, if you pick quality investments. If you bet on a horse, you probably need to think about the bad ROI for that type of “investment.”

The author then says betting on a horse is like betting on the stock market. He said, “The stock market works the same way. The more popular a business is, even if it is indeed going to be a big winner, the lower the returns of the investment will be because the purchase price of the stock relative to future earnings will be higher. When it comes to dividend investing, this can all be reduced down to the dividend yield at the time of purchase, along with the dividend growth during the holding period. For now, let’s just focus on the dividend yield itself. The higher the yield when purchased, the less popular the investment was at the time, and the lower the dividend yield, the more popular it was. Very simple.” There is much truth in this paragraph, aside from the bad illustration related to gambling.

My Response to Author

This is what I said to the author: “I have absolutely no desire to sell my SCHD holdings. While I might get a better current yield from other investments, I prefer a dividend growth strategy. SCHD is just one of a couple of ETFs I own. The 5-year dividend growth rate is more than satisfactory.”

What Should You Do?

Let me strongly suggest that you have a strategy. It does not have to be dividend growth, but I would say it should be anti-bond and anti-annuity. There are exceptions to this “rule”, as there are some who might benefit from tax-free bonds and others who might need an annuity for specific reasons. However, the vast majority of investors would do well to avoid or minimize putting money into annuities and bonds.

Full Disclosure

I have no plans to sell any of our investments.

Final Word

I think bonds are a poor long-term choice for most investors. Furthermore, “The plans of the diligent lead surely to abundance, but everyone who is hasty comes only to poverty.” Proverbs 21:5

Seeking Alpha Link