What Type of Investor Are You?

“The Tortoise and the Hare” is one of Aesop’s Fables. In a race, it seems that the rabbit should be the winner. In fact, the fable almost seems ridiculous. It assumes the hare will take a nap. However, the perseverance of one creature over another can make a difference in survival and success. Proverbs 13:11 (ESV) says, “Wealth gained hastily (or by fraud) will dwindle, but whoever gathers little by little will increase it.” The NIV version says, “Wealth gained dishonestly dwindles away, but whoever works diligently increases his prosperity.”

There is an investing mentality (hare-brained) that seems to think that it is better to take big risks and get a home run. This type of investment can make a very small number of investors wealthy in a very short timeframe. For example, if you can buy 1,000 shares of stock at $1 per share on Monday and sell those shares by the end of the day (or by Friday) for $10 per share, you have a quick and rather sizable return on your investment. The problem with this home run thinking in investing, just like in baseball, is that there are more singles and doubles than there are triples and home runs.

A Quick Review

In the first post in this series I talked about something often neglected by investors: “Market Capitalization for Diversification.” This included definitions of large, mid, and small-cap stock and ETF investments. If you read that piece, you probably recall that I don’t allocate our investment dollars in the same weighting as the broad market. I tend to prefer a heavier weighting on the mid-cap section of the market. The reason I do this is that I think there is more potential for more doubles over the long haul. I’m not looking for home runs. In fact, I believe it is far better to have ten singles and a couple of doubles than to search for the home runs.

Value or Growth Investing?

Although I don’t intentionally pick a stock or ETF for value or growth, there are a couple of reasons you will see that I have a leaning towards value. It is important to start by defining some terms and then you can be better prepared to evaluate your portfolio of investments. These definitions come from Fidelity Investments’ online glossary. LINK

Growth – “Growth stocks are those issued by companies whose earnings per share have the potential to grow significantly faster than the market. These stocks tend to trade at higher-than-average P/E Ratios because investors are willing to pay more for these stocks in the belief that company earnings will grow faster than the market average.” In other words, this is hare investing. That isn’t necessarily bad or good, but it introduces the potential for higher risk and higher stock price volatility. It is home run thinking. Unfortunately, there are many factors that can cause the investor to strike out or lose money in a 100% growth strategy.

Value – “Value stocks are stocks that are priced lower in relation to the issuer’s earning potential. These stocks often trade at below-average P/E Ratios. In general, stocks are considered ‘value’ stocks when their potential growth has yet to be recognized by the market.” As an aside, it is important to realize that the P/E (price/earnings) ratio can vary significantly by market sector. For example, the P/E for a communications company should be compared with the P/E of another communications company, not with a health care or technology company. Some might equate this type of investing with the tortoise. It has the potential to result in some consistent “singles.”

There is a third general category known as the blend. “Blend stocks have a combination of growth and value characteristics; when the stock’s growth and value characteristics are similar in strength, the stock is considered to have a ‘blend’ style.” You might think this is the best strategy, and you might be right.

Retirement Value

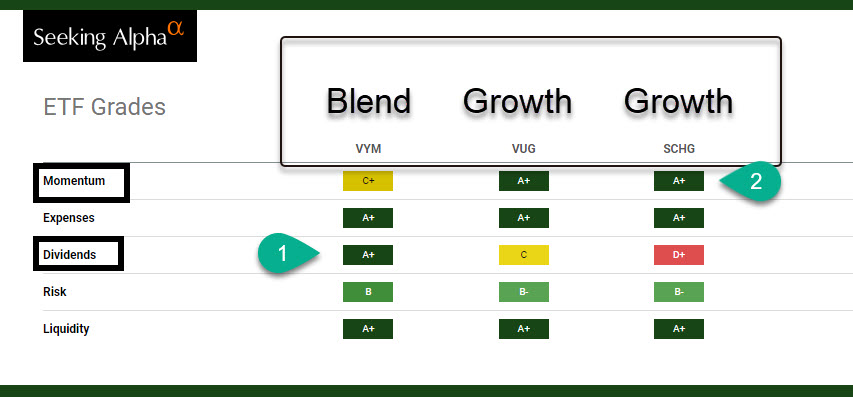

In the early portion of building a portfolio of investments, many investors (and their advisors) focus on growth stocks. Dividend or interest income is unnecessary because the income isn’t needed. Income for these individuals is in the form of pay from an employer. So it might be just fine to buy shares in a growth ETF or mutual fund. One example is VUG (Vanguard Growth Index Fund ETF Shares.) Another is SCHG – Schwab U.S. Large-Cap Growth ETF.

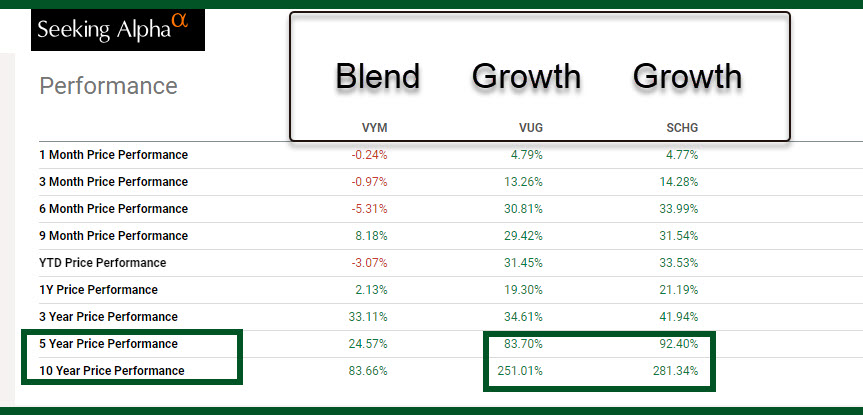

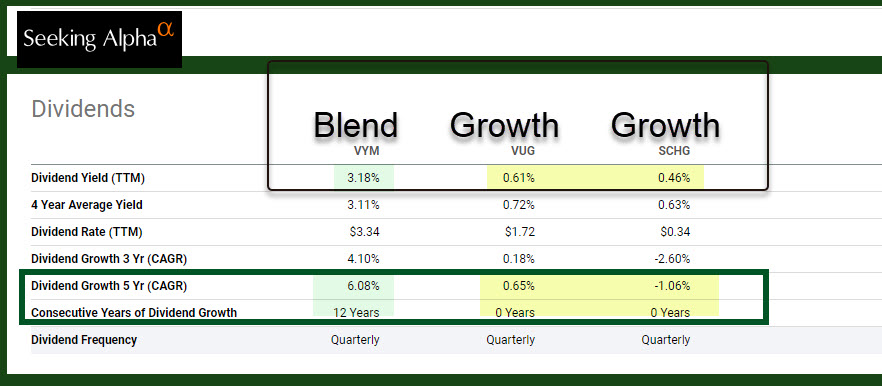

VUG and SCHG have low expense ratios (0.4%) and also low dividend yields. VUG has a yield of 0.61% while the Schwab fund has a yield of 0.46%. You cannot live on that type of income in retirement unless you have ten million dollars of assets. However, the ten-year price performance for these two are 281.34% (Schwab) and 251.01% (Vanguard).

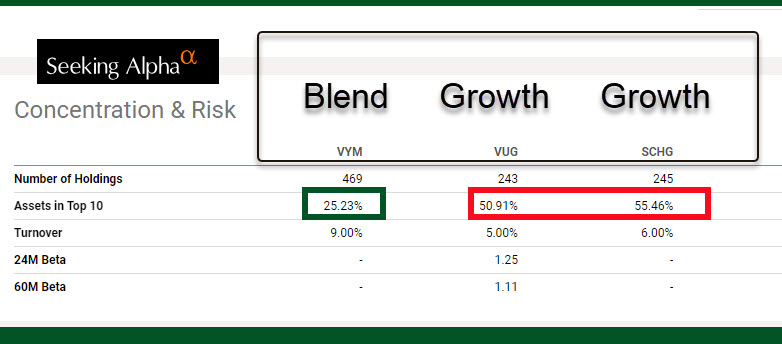

A word of caution is in order. The top two investments in VUG are Apple and Microsoft. Both are technology stocks. The two make up 16% of the 243 stocks in VUG. That is a high-risk strategy. SCHG has a similar weighting in the same two investments. Nevertheless, growth can result in some excellent growth when income isn’t needed.

There is a slight problem with this strategy. When you reach retirement, you probably will need to start shifting to a mix of investments that provide more income. This means you will likely sell some of your growth stocks or ETFs and purchase more value investments. The reason is that many value investments pay a quarterly dividend. The yield on these investments can range from 1% to 5%, with some yields even higher than that.

Some advisors specialize in helping a new retiree switch from growth investments to income producing investments. I question the value of engaging in those services. Most investors can learn how to sell their growth investments and buy income investments. For example, an investor could sell a portion of their VUG and replace those shares with VYM. (VYM has a dividend yield of 3.18% and 469 positions. It also does not have a top ten allocation that includes Microsoft and Apple.)

VYM Vanguard High Dividend Yield Index Fund ETF Shares

VYM could be considered a Blend investment. “Vanguard Whitehall Funds – Vanguard High Dividend Yield ETF is an exchange traded fund launched and managed by The Vanguard Group, Inc. The fund invests in stocks of companies operating across diversified sectors. The fund invests in growth and value stocks of companies across diversified market capitalization. The fund invests in dividend paying stocks of companies.” – SOURCE: Seeking Alpha

Bear in mind that VYM is just one of many different similar types of dividend yield investments. The reason that it is our number one holding is that it has market cap diversification, a blend of growth and value, and a decent dividend profile. It also has a low expense ratio of 0.06%. VYM won’t hit any home runs, but it can easily deliver singles and perhaps some doubles.

Our Current Weightings

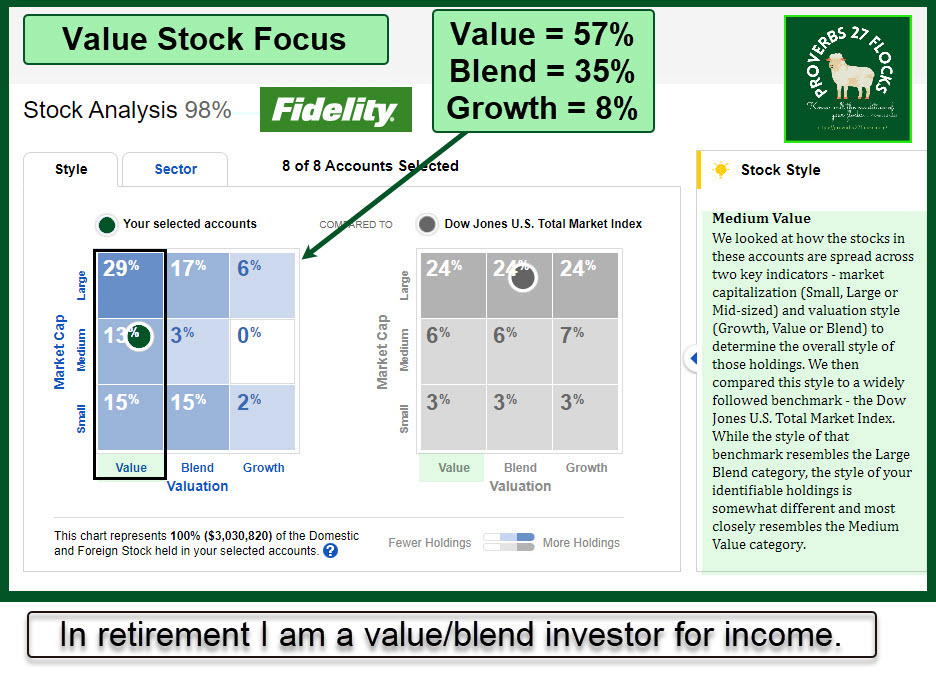

The following image, from Fidelity Investments, illustrates our current value, blend, and growth weightings. You can easily see that I am not focused on “growth.” At 72 years old, Cindie and I don’t need more assets. We prefer to have income for charitable giving.

Suggestion or “Homework Assignments”

Evaluate your mutual funds, ETFs and stocks to see what type of investor you are. Also, if you have an advisor, ask them what type of investor they are and why they recommend what they recommend for your retirement investments.

Full Disclosure

Cindie and I own sizable portions of investments like VYM, AVGO, MAIN, PFE, and ABBV. We do not own shares of VUG or SCHG.