Ignorance is Not Bliss and Common Sense is Not Common

Each time I meet with someone who is interested in learning more about their investments, I realize that things I consider basic investment knowledge are unknown to most people. Most working adults have a choice of retirement accounts from their employers, and most of these accounts utilize mutual funds for growing your retirement nest egg. Sadly, most people I talk to do not know what a mutual fund is, what an ETF is, or even what a CD (Certificate of Deposit) is. This points to the failure of the public schools to give students some basic financial knowledge.

What is a Mutual Fund?

A mutual fund is essentially a collection of various types of investment assets. This can include company stocks, corporate bonds, cash, and even precious metals. The benefit of this is that an investor can buy one or more shares of the fund and have some level of diversification. Diversification can often help protect the investor from catastrophic loss. Rather than just buying stock in one company, like Apple or Microsoft, you buy a mutual fund like BLPSX (ProFunds Bull Investor Fund S), and you then get a mix of 511 different investments. This mutual fund includes stocks, bonds, and cash. It is, by the way, a terrible mutual fund.

Another mutual fund is FCNTX (Fidelity® Contrafund® Fund No Load). This fund is decidedly better than BLPSX but it is focused on stocks with 97% of the fund’s assets. There are 360 stocks in this fund. However, the top ten make up over 50% of the funds total value. This fund is diversified, but it is also a high-risk investment.

It is easy to spot a mutual fund by looking at the ticker symbol. Both BLPSX and FCNTX end in the letter “X.” If the ticker symbol is five letters and ends in the letter X, it is a mutual fund. This includes funds that we use for our excess cash in our Fidelity brokerage, UTMA, and retirement accounts: FDRXX, SPAXX, and FZFXX.

Reasons Mutual Funds Are Not Your Friend

First of all, if your 401(k) or 403(b) retirement plan offered by your employer has mutual funds, it isn’t because they don’t have your best interests in mind. However, I have seen plans that have poor fund choices, and others that have decent fund options. In general, however, mutual funds are not always the best investment option – if you can manage your own traditional IRA or ROTH IRA. Your financial advisor may tell you that they are, but you need to ask a lot of questions and understand what you are buying and what you are paying for each investment and for the advice and management fees you are paying your advisor. These costs add up.

There are several reasons why I avoid mutual funds. Let me talk about the top two.

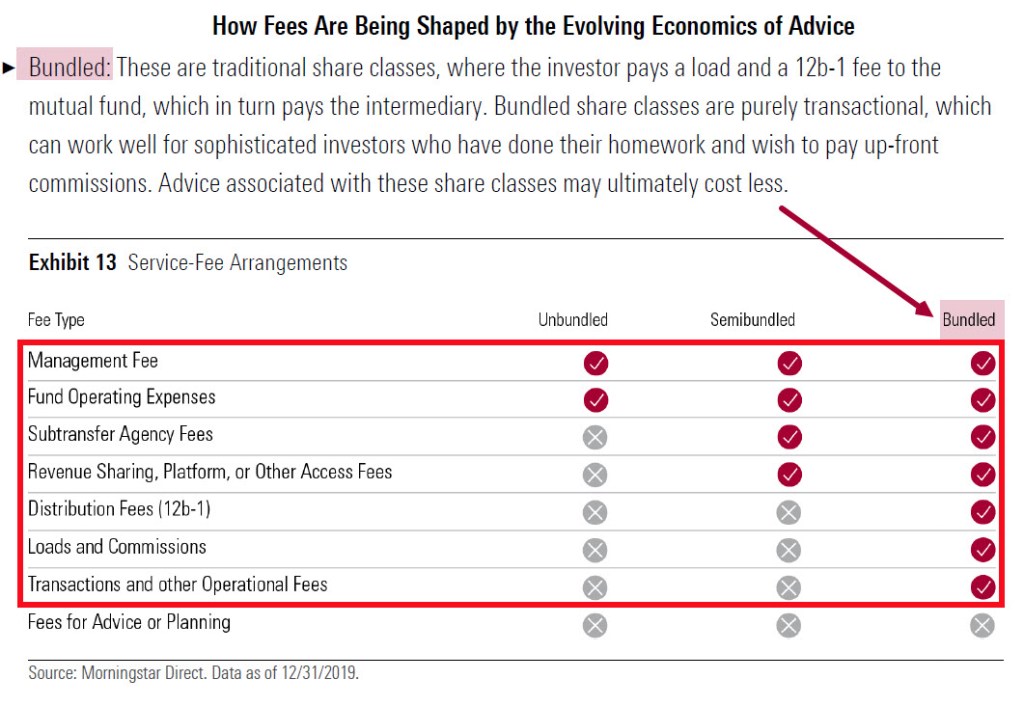

The first is that mutual funds tend to be “actively managed.” That sounds good on the surface, but many studies have shown that actively managed funds, which cost more than passively managed funds, do not deliver the goods. With an actively managed mutual fund, the fund manager(s) are buying and selling stocks and bonds throughout the year. There are costs associated with their work. You are counting on them to buy low and sell high. In a sense, you are letting them time the market for you. That is a high-risk approach to investing. It also adds costs in the form of various “hidden” charges that most investors, to their own harm, ignore.

In addition to higher costs, you don’t really know how much you will pay for a mutual fund until the market closes. Funds sell at the close of day price, if sold prior to close. In other words, until the stock market closes you cannot know how much you will pay for each mutual fund share. You cannot buy or sell a mutual fund in the middle of the day. You can enter your buy or sell order anytime during the day, but you won’t be able to know the price you are paying until the market closes. If the sell order for a fund is entered after the close, it will sell at the next trading day’s closing price. This is like a used car dealer asking you to sign the contract for the SUV, and then when you are leaving the dealership the salesperson gives you the price. Ouch!

ETFs (Exchange Traded Funds) are the investment I prefer. This includes ETFs like VYM, SCHD, and DGRO. ETFs sell at the time of execution price. This is similar to buying or selling a stock. Furthermore, you can enter buy limit and sell limit orders to define the price you are willing to pay for the ETF shares.

When You Leave An Employer

Therefore, because of the benefits of holding ETF shares, if you leave an employer, I recommend that you roll your employer’s plan into your own IRA or ROTH IRA. You can sell the mutual funds and then start to buy lower-cost ETFs that fit your strategy.

Each time I left an employer, and this happened three times, I moved the 401(k) assets to my own Fidelity traditional IRA and ROTH IRA. Traditional 401(k) assets are moved to a traditional IRA (pre-tax) and ROTH 401(k) assets are moved to a ROTH IRA.

If you have questions, please contact me. I’m always willing to help.