What is a BDC?

“A Business Development Company is a form of unregistered closed-end investment company in the United States that invests in small and mid-sized businesses. This form of company was created by Congress in 1980 as amendments to the Investment Company Act of 1940. Publicly filing firms may elect regulation as BDCs if they meet certain requirements of the Investment Company Act.” Wikipedia

“BDCs invest in private companies and small public firms that have low trading volumes or are in financial distress. They raise capital through initial public offerings or by issuing corporate bonds and equities or forms of hybrid investment instruments to investors.” – Investopedia

What is Important?

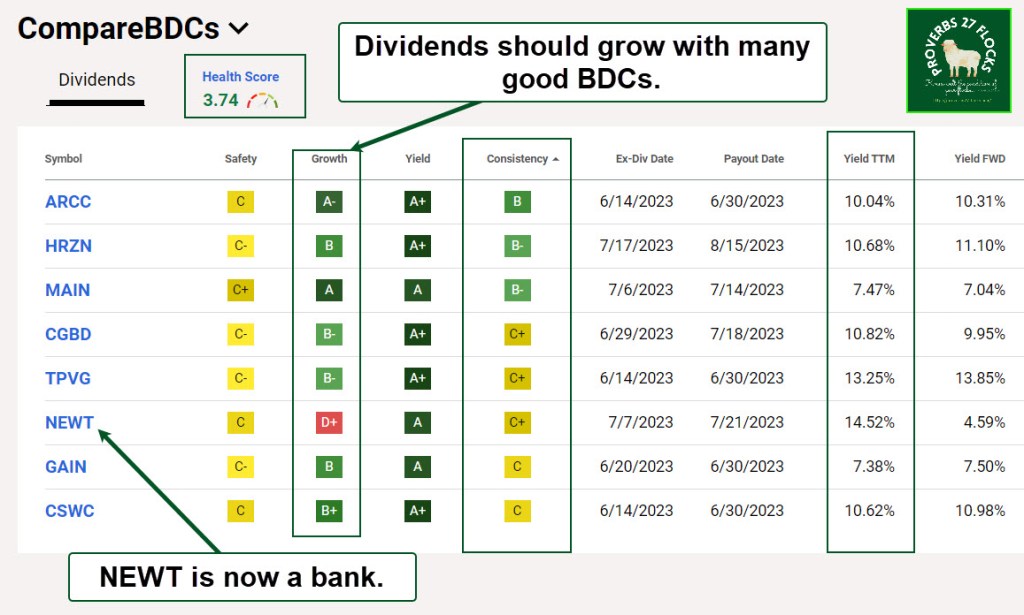

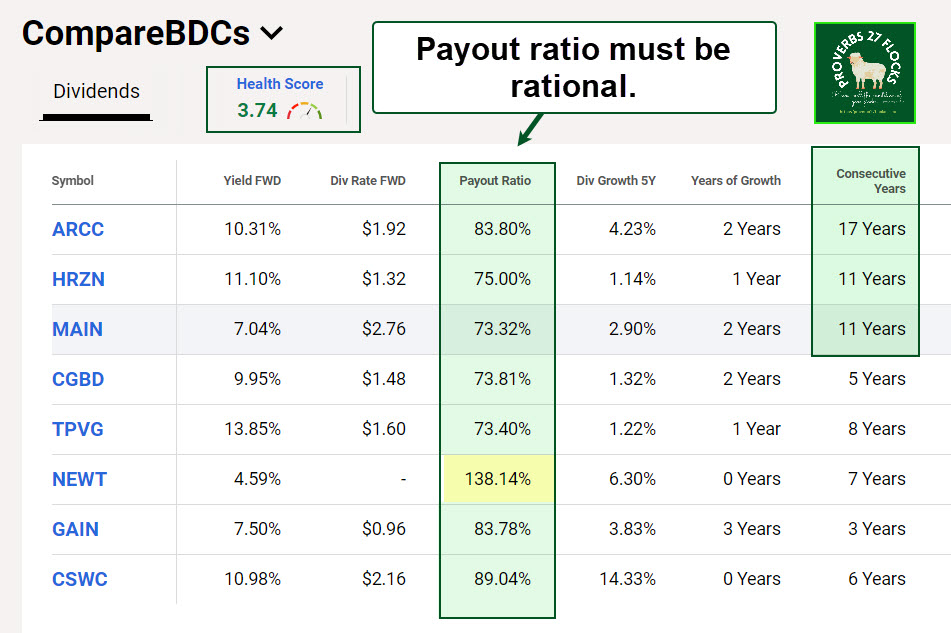

One of the nice thing about some BDCs is that they pay a monthly dividend. That is true of MAIN and GAIN. But that should not be your only criterion. It is important to consider dividend growth, the dividend payout ratio (is the dividend likely to increase or decrease?), the demographics of the businesses in the BDC, the ten-year total return, and the consecutive years of dividend growth. Sometimes businesses change as well. For example, NEWT is transforming from a pure BDC to a bank. That has caused some distress for BDC-focused investors.

Telling the Story from Seeking Alpha

The following images illustrate how eight decent BDCs compare with each other. It is best to buy shares in 2-3 BDCs rather than focusing on a single BDC. However, if I had to pick my favorites, then I would pick MAIN, ARCC, CSWC, and GAIN.

Full Disclosure

MAIN is in our top ten investments. We also hold some sizable portions of GAIN, ARCC, and CSWC.

Hi Wayne,

In case you missed it, ARCC is looking to sell shares below nav if approved via special vote in August.

Eniac

LikeLiked by 1 person

I am aware of that. In reality, that isn’t all that uncommon. What matters more to me is what they plan to do with the proceeds. This is a portion of the proxy:

To the Stockholders of Ares Capital Corporation:

Notice is hereby given that a Special Meeting of Stockholders (the “Special Meeting”) of Ares Capital

Corporation, a Maryland corporation (the “Company”), will be held virtually on August 8, 2023 at

2:00 p.m., Eastern Time for the following purpose:

To consider and vote upon a proposal to authorize the Company, with the approval of its board of

directors, to sell or otherwise issue shares of its common stock at a price below its then current net

asset value per share subject to certain limitations set forth herein (including, without limitation,

that the number of shares issued does not exceed 25% of its then outstanding common stock).

The Board, including a majority of the directors who have no financial interest in this proposal and a

majority of the directors who are not “interested persons,” as that term is defined in Section 2(a)(19) of the

Investment Company Act (referred to herein as “independent directors”), has approved this proposal as in

the best interests of the Company and its stockholders and recommends it to the stockholders for their

approval. For these purposes, directors will not be deemed to have a financial interest solely by reason of

their ownership of the Company’s common stock. The Board believes that having the flexibility for the

Company to sell its common stock below NAV in certain instances is in the Company’s best interests and

the best interests of its stockholders. This would, among other things, provide access to the capital markets

to pursue attractive investment opportunities during periods of volatility and improve capital resources to

enable the Company to compete more effectively for high quality investment opportunities (which may

include acquisitions of other companies or investment portfolios) and to add financial flexibility to comply

with regulatory requirements and debt facility covenants, including the applicable debt to equity ratio. Upon

obtaining the requisite stockholder approval, the Company will comply with the conditions described below

in connection with any offering undertaken pursuant to this proposal.

LikeLike

Thank you Wayne, for this excellent blog article. Would you please consider providing feedback on my favorite BDC Stellus Capital Management (SCM). It seems to have a very good 5-year history of increasing income as well as dividends. Thank you 🙏

LikeLike

Good morning Paul, I hold 1,000 shares of SCM. For the reasons you stated, and because I think this BDC will continue to grow its revenue, I would not be afraid to add more shares. The Seeking Alpha QUANT rating is also a buy, and that is one of the factors I consider when buying a BDC. SCM is ranked 25 out of 94 in the industry, and that is a good ranking. MAIN is ranked 16, but GAIN is currently at 64. It is best to try to buy these on the dips. Hope this helps. Wayne

LikeLike