Do T Bills, Bonds and CDs Win?

For my age category, as a “baby boomer,” I am a nonconformist and perhaps a maverick. A maverick can be defined as “A person who shows independence of thought and action, especially by refusing to adhere to the policies of a group to which he or she belongs.” – Source: The American Heritage® Dictionary of the English Language, 5th Edition.

The “group” to which I belong are called boomers. That group, common wisdom says, should have a heavy allocation in bonds or “safe” investments. In fact, a recent contributor in the Fidelity Investor Community asked a question that I have seen repeated many times with different variations. This time the question was, “But now T Bills, Bonds and CDs yield over 5%, so why are you still into equities?”

The Context from the WSJ

This cautionary note from the front page of today’s WSJ:

“Boomers Got Hooked on Stocks. Now They Can’t Let Go. – Two-Thirds of U.S. adults age 65 and older have money in stocks.”

“When it comes to investing, older Americans can’t quit their stock-market habit. Nearly two-thirds of U.S. adults age 65 and older own equity through individual stocks, mutual funds or retirement savings accounts, according to an April survey by Gallup. That is up from roughly half of Americans in the same age cohort before the 2008 financial crisis—the only age group to see stock ownership rates rise over that period.”

“Conventional financial wisdom suggests investors should rotate from risk assets such as stocks into havens such as bonds as they get older. But many abandoned the old “100 minus age” equity-allocation rule when, for much of the past decade, the stock market appeared to be the only place to get returns as interest rates hovered near zero.” – WSJ

Another Perspective From Fidelity Viewpoints

“On average, stocks have actually posted above-average returns in historical periods following steep sudden declines in financials (excluding the financial crisis). The financial sector has experienced declines of 7% or more in about 1 out of every 50 weeks (or 2% of the time), going back to 1970. If you exclude the global financial crisis, then in the 12 months following those periods, the S&P 500® returned an average of 14%. I think this finding offers reason for cautious optimism as long as you don’t think we’re in a replay of 2008 (which I don’t).” LINK

My Rationale as a Maverick

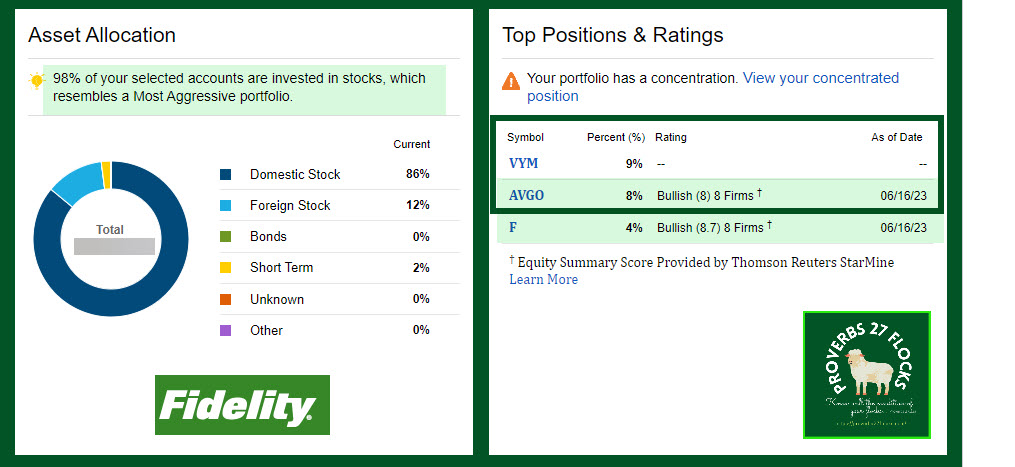

“So why are you still into equities?” The answer to the question has multiple facets. First of all, I already realize a yield based on my mix of investments of 4.82%. Secondly, our annual income grows by a significant amount from a dividend growth strategy. Thirdly, I can trade covered call options on most positions, including ones like TSLA that do not pay a dividend. Finally, income from Social Security more than covers all normal living expenses.

Using my strategy, I am going to start taking my first RMD in 2024 and dividends in my traditional IRA more than cover the RMD. The RMD will be fairly large, and that can be used for charitable giving, income taxes, and reinvesting in a taxable brokerage account. We are also planning a trip to Hawaii in 2024 with our second-oldest granddaughter. We are looking forward to seeing Oahu and Kauai again, and to seeing Maui for the first time.

Full Disclosure

The following images from Fidelity Investments help you see how we allocate our investments.