Not Everyone Likes or Recommends VYM

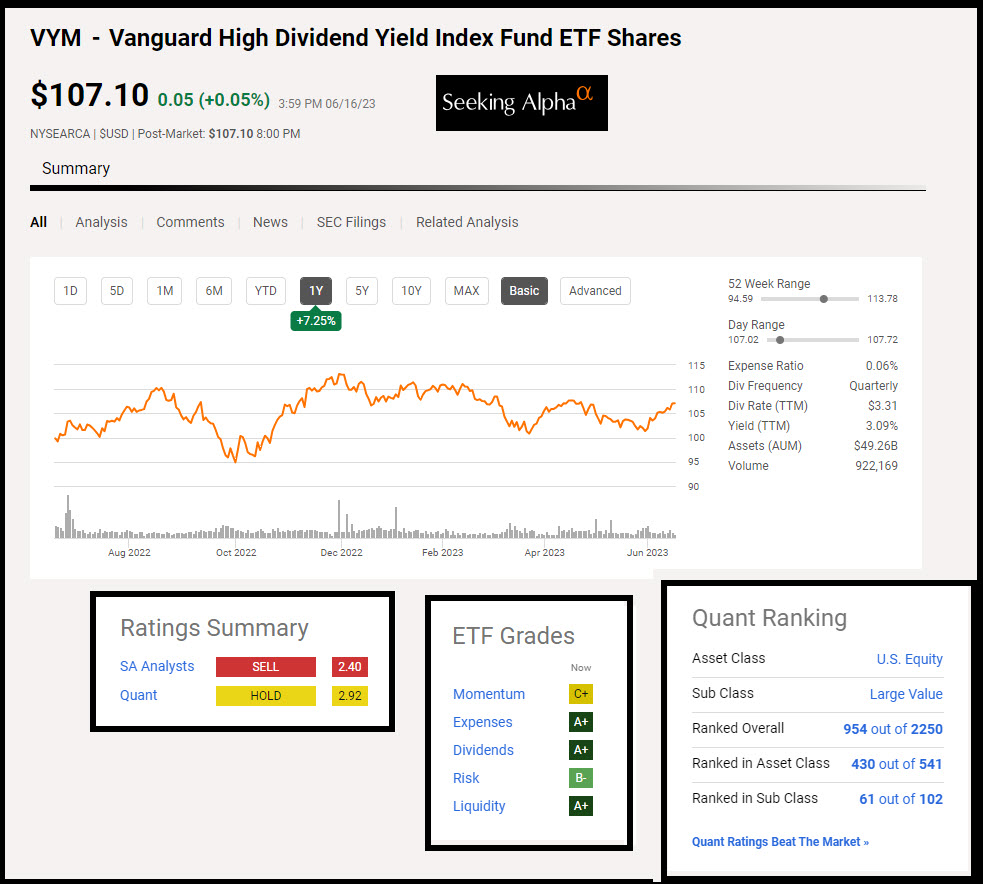

If you look at the Seeking Alpha author recommendations, you would not buy VYM shares. Vanguard High Dividend Yield Index Fund ETF, however, is not as bad as some authors would have you think. Some of this is driven by inflationary and recessionary fears. Some of it is due to a lack of share price growth. The things I have seen have not changed my opinion of VYM. It is our number one investment by total dollars, and it will remain so. Let me tell you why by looking at some “tens.”

Long-Term Investors Think Long-Term

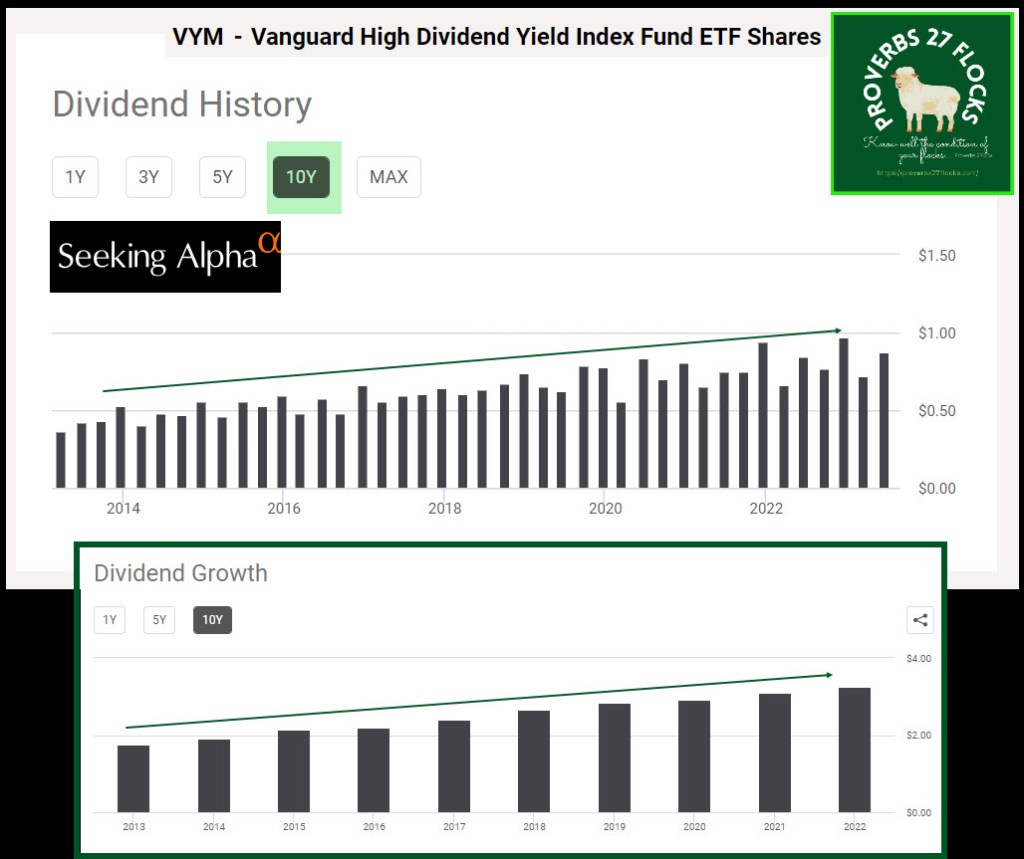

Duh! Of course they do, don’t they? Clearly not all long-term investors have the same requirements for income. Retirees are likely to want a good income stream that grows over time. For those reasons, I have a normal process that looks at some tens for our investments. Let’s look at VYM’s ten-year dividend track record, the ten-year returns, and the top ten holdings. Those tens tell a story.

VYM’s Ten-year Dividend Track Record

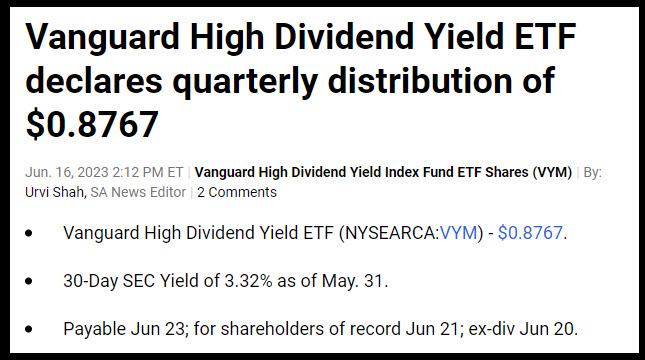

For investments like ETFs, it is sometimes hard to judge if the graph shows a year-over-year increase. Seeking Alpha lets you see a graph for every quarterly dividend, but you can also view a ten-year graph. As you can see in the following illustration, the trend is upward. This is significant. Do you remember Covid-19? The stock market “crashed” but most companies continued to pay their dividends, and many increased their dividend during the difficult two years of Covid.

VYM’s Ten-year Returns

I don’t think it is unreasonable to expect an investment to grow by 8-10% per year. In fact, I question the value of investments (like bonds) that don’t have that potential. VYM, as you can clearly see, has a ten-year return of 90%. That means the value of your investment almost doubled when you include price appreciation and dividends. Bear in mind that you can reinvest dividends, and that makes the pile of shares grow even bigger. That also results in more dividends. All of this comes to you with a low expense ratio of 0.06%.

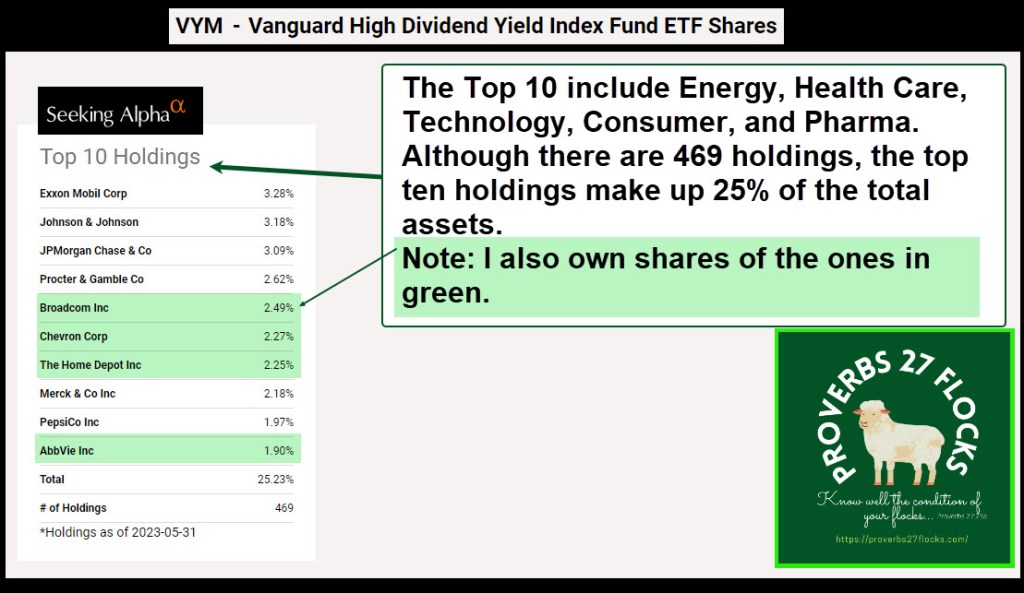

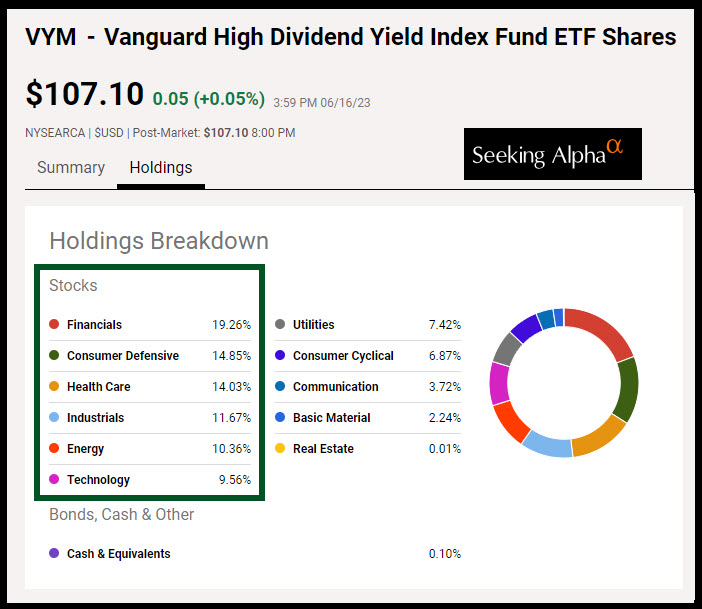

VYM’s Top Ten Holdings

The third “ten” is the top ten holdings. Far too often the top ten are a list of “me too” stocks like Amazon, Facebook, Tesla, Google, and Microsoft. There is a place for those in your portfolio, but far too many funds hold far too much of these big five in their top ten. VYM, on the other hand, has good diversification in the entire portfolio. That includes both sector diversification and top-ten diversification. It is important to note that none of the top ten are more than 3.5% of the total investment. If you buy shares of an S&P 500 index fund, the top two investments (Apple and Microsoft) make up almost 15% of the total investment dollar. (SPY SPDR® S&P 500 ETF Trust.)

Full Disclosure

Cindie and I own 2,610 shares of VYM as a long-term investment. As a result, it is in the top ten investments we hold. This is not a recommendation for you to buy VYM. However, I do like the fact that our next dividend from Vanguard for our VYM shares will be $2,288. In other words, that is the same as a monthly income of $762. That buys a lot of groceries.

I appreciate VYM’s predictability and history as I can expect/depend on a distribution increase each year in the 5 to 6% range. Being just a few years away from retirement I now value predictability more than ever.

On the historical front, the majority of ETFs with dividend growth characteristics were created after the financial crisis yet VYM originated prior to the crisis in Nov 2006. VYMs performance during the financial crisis had a total drop from its 2008 distribution payment of circa -25% and it took 3 years to recover versus the S&P 500 which took 5 years. This was extremely vital to my planning as I now have a 30% income loss risk baked into my retirement plan and an emergency fund to cover the loss for 3 years.

LikeLiked by 1 person

This is a helpful addition to what I said. Thanks for sharing it. Yes, there should always be a realization that extremely bad news or difficult times can impact income. Therefore, having a plan for those times is a wise approach. Most of the income we receive we don’t really need for our living expenses. That gives us more wiggle room than most seem to have.

LikeLike