ASE Technology Holding Co

One thing the long-term investor needs is patience. Patience is an admirable quality for farmers, parents, fishermen, deer hunters, negotiators, and counselors. But it is also a useful character quality for investors. The scriptures tell us that this is one evidence of the work of the Holy Spirit in the life of a follower of Jesus: “But the fruit of the Spirit is love, joy, peace, patience, kindness, goodness, faithfulness, gentleness, self-control; against such things there is no law.” Galatians 5:22-23

What is ASE Technology?

ASX is an Information Technology company that is focused in Semiconductors. Some have been fearful about its prospects because it has its headquarters in Taiwan, and Taiwan faces threats from China. However, all of life is full of threats, even here in the relatively safe USA.

ASE Technology Holding Co., Ltd., together with its subsidiaries, provides semiconductors packaging and testing, and electronic manufacturing services in the United States, Taiwan, Asia, Europe, and internationally. It develops, constructs, sells, leases, and manages real estate properties; produces substrates; offers information software, equipment leasing, investment advisory, and warehousing management services; processes and sells computer and communication peripherals, electronic components, telecommunications equipment, and motherboards; and imports and exports goods and technology. ASE Technology Holding Co., Ltd. was founded in 1984 and is headquartered in Kaohsiung, Taiwan.

The Ride Has Been Wild

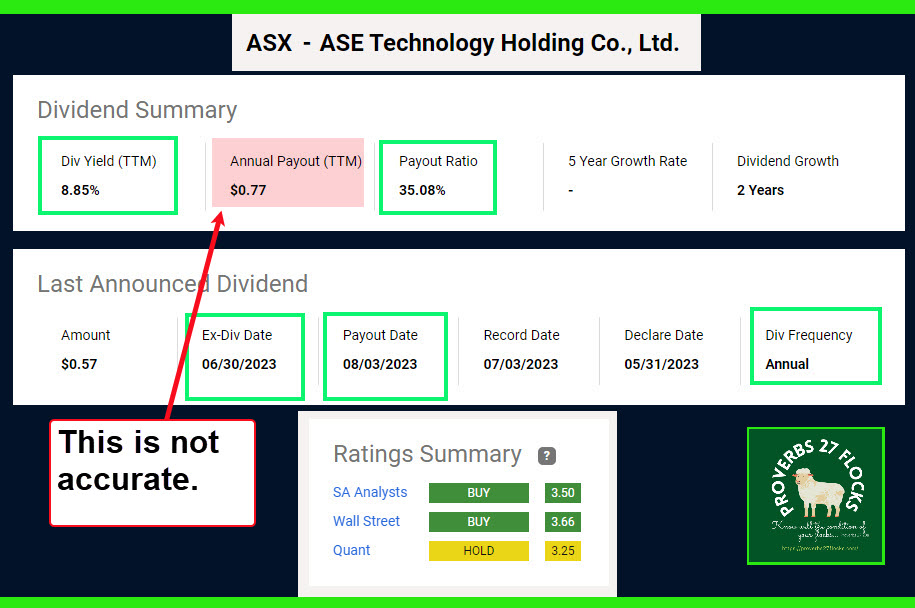

The following image shows the roller coaster ride of the price of ASX shares. The current Seeking Alpha QUANT rating on ASX is “hold” but both Wall Street and Seeking Alpha authors say it is a buy. The Fidelity Equity Summary Score is a bullish 7.2 out of 10. Bear in mind that there is a strong correlation between the Seeking Alpha Wall Street score and the Fidelity score.

Not too long ago (1) the price of the shares was below my cost basis. Now the shares are (2) up over 14%. One of the reasons may be that the shares go ex-dividend on June 30. The yield on this investment is 8.66%, according to Seeking Alpha this morning. That is in error. Always be suspicious of numbers that you see on any web site. It pays to check more than one. Fidelity’s yield is far more accurate.

Bear in mind that ASX pays dividends annually. This is both a blessing and a curse. It is a blessing because it is easier to see if earnings can cover the dividend. It is a curse because you only receive the dividend once each year. In our case, the 2,800 shares will result in $1,601.32 of cash in my ROTH IRA on August 3. However, I only have to hold the shares until June 30 to receive the dividend.

Summary

I did this post because we all need reminders that patience is part of the long-term investor’s arsenal of tools. Don’t immediately assume the worst when the market seems to think the sky has fallen.

Full Disclosure

Cindie and I own 2,800 shares of ASX as a long-term investment.

All scripture passages are from the English Standard Version except as otherwise noted.