What ETFs Might Work?

ETF VYM has a focus on the financial sector, consumer defensive, healthcare, industrials, and energy in the top ten sectors. Real Estate, on the other hand, is 0.01% of the fund. SCHD, another one of my favorites, has no real estate exposure. DGRO (iShares Core Dividend Growth ETF) also is lacking in real estate exposure. This is a huge miss for the investor in retirement.

Each time I have looked at Real Estate ETFs I have been disappointed in the choices. VNQ (Vanguard Real Estate Index Fund ETF Shares), for example, has a decent 4% yield, but it has 169 holdings. At first you might think, “that is good!” But sometimes more diversification is just hiding some problems. For example, there are at least 252 real estate stocks based on my Seeking Alpha search (there may only be about 225 based on other data I found), but at least fifty of them are very risky and of poor long-term potential. Diversification for the sake of diversification is a bad idea.

Our Top Five Real Estate Investments

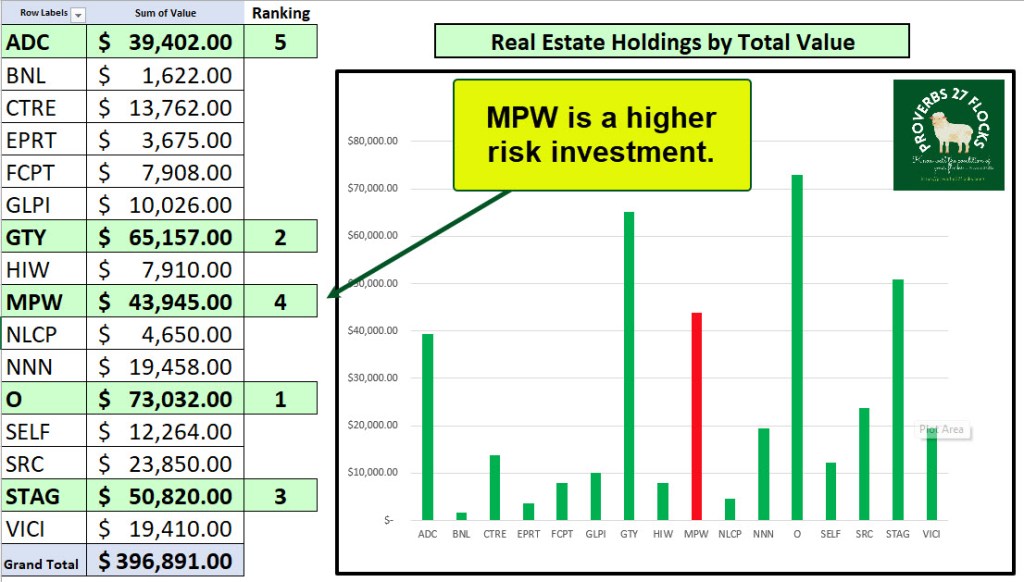

Our top five Real Estate Investments are O, GTY, STAG, MPW, and ADC. What follows is a description of each REIT. What I would like for you to notice is that there is diversification into many different types of real estate. Much of this is retail, but even within retail there is diversification. For example, I don’t like shopping malls or offices, but I like free-standing real estate, hospitals, and industrial holdings. The following two images are from Stock Rover’s website. They help illustrate our REIT holdings.

Here is a description of our top five REITS…

Realty Income Corporation (O)

Realty Income, The Monthly Dividend Company, is an S&P 500 company and member of the S&P 500 Dividend Aristocrats index. We invest in people and places to deliver dependable monthly dividends that increase over time. The company is structured as a real estate investment trust (“REIT”), and its monthly dividends are supported by the cash flow from over 12,200 real estate properties primarily owned under long-term net lease agreements with commercial clients. To date, the company has declared 632 consecutive monthly dividends on its shares of common stock throughout its 54-year operating history and increased the dividend 119th times since Realty Income’s public listing in 1994 (NYSE: O).

Getty Realty Corp. (GTY)

This REIT is a publicly traded, net lease REIT specializing in the acquisition, financing and development of convenience, automotive and other single tenant retail real estate. As of December 31, 2022, the Company’s portfolio included 1,039 freestanding properties located in 38 states across the United States and Washington, D.C.

STAG Industrial, Inc. (STAG)

We are a REIT focused on the acquisition, ownership and operation of industrial properties throughout the United States. We seek to (i) identify properties for acquisition that offer relative value across all locations, industrial property types, and tenants through the principled application of our proprietary risk assessment model, (ii) operate our properties in an efficient, cost-effective manner, and (iii) capitalize our business appropriately given the characteristics of our assets. We are organized and conduct our operations to maintain our qualification as a REIT under Sections 856 through 860 of the Internal Revenue Code of 1986, as amended (the “Code”), and generally are not subject to federal income tax to the extent we currently distribute our income to our stockholders and maintain our qualification as a REIT. We remain subject to state and local taxes on our income and property and to U.S. federal income and excise taxes on our undistributed income. As of December 31, 2022, we owned 562 buildings in 41 states with approximately 111.7 million rentable square feet, consisting of 484 warehouse/distribution buildings, 74 light manufacturing buildings, one flex/office building, and three Value Add Portfolio buildings. While the majority of our portfolio consists of single-tenant properties, we also own multi-tenant properties and may re-lease originally single-tenant properties to multiple tenants.

Medical Properties Trust, Inc. (MPW)

Medical Properties Trust, Inc. is a self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities. From its inception in Birmingham, Alabama, the Company has grown to become one of the world’s largest owners of hospital real estate with 444 facilities and approximately 44,000 licensed beds in ten countries and across four continents. MPT’s financing model facilitates acquisitions and recapitalizations and allows operators of hospitals to unlock the value of their real estate assets to fund facility improvements, technology upgrades and other investments in operations. This REIT is not for the faint-hearted investor.

Agree Realty Corporation (ADC)

Agree Realty Corporation is a publicly traded real estate investment trust that is RETHINKING RETAIL through the acquisition and development of properties net leased to industry-leading, omni-channel retail tenants. As of December 31, 2022, the Company owned and operated a portfolio of 1,839 properties, located in all 48 continental states and containing approximately 38.1 million square feet of gross leasable area.

Which One is Best?

If I had to recommend only one REIT, I would suggest O. But if you had $30,000 to invest in real estate, I would be inclined to suggest equal portions of O, GTY, and STAG. This increases your diversification and keeps your focus on higher quality.

What Do We Own?

The next two images show you some Excel pivot tables of the Real Estate in our portfolio. As you can see (by total value), O and GTY are the largest investments. However, MPW currently provides the bulk of the income. This might not be sustainable if hospitals continue to struggle. That is why O and GTY are also providing significant income in our overall portfolio.

Recommendation

If you have a portfolio of more than $250,000 in assets, then I suggest you have at least ten percent of your portfolio in Real Estate. In retirement you might want to increase that to fifteen percent. The “easy” way to do this would be VNQ. The better way would be O, GTY, and STAG.