What ETFs Might Work?

As a general rule, I buy ETFs that have a history of increasing dividends. However, I have quite a few individual stocks in the financial sector. Many of those have a very high yield and some also have good growth potential. ETF VYM has a financial sector stock in the top ten: JPMorgan Chase & Co. DGRO does likewise. SCHD, however, does not.

There are some Financial Sector ETFs worthy of consideration. They include VFH, FNCL, and IYF. IYF is “iShares U.S. Financials ETF,” VFH is the “Vanguard Financials Index Fund ETF Shares,” and FNCL is called the “Fidelity MSCI Financials Index ETF.”

FNCL holds the following stocks in the top five: Berkshire Hathaway Inc Class B (8.07%), JPMorgan Chase & Co (7.72%), Visa Inc Class A (6.97%), Mastercard Inc Class A (5.97%), and Bank of America Corp (3.89%). The top ten are 43.87% of the total assets, and there are 415 positions in this ETF.

Which One is Best?

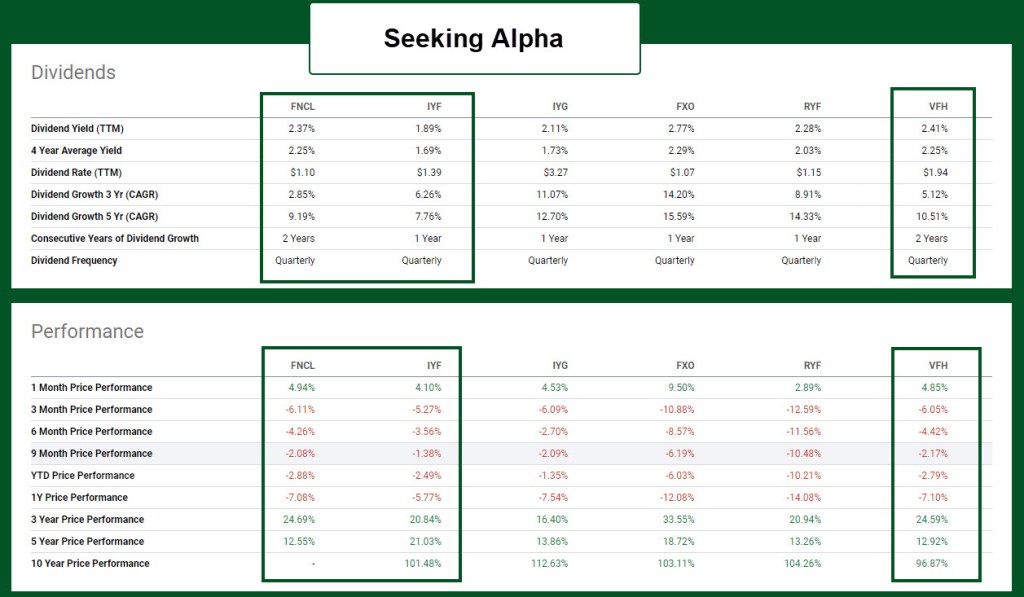

It depends on your definition of “best.” Do you want the highest dividend yield, the longest history of dividend increases, the lowest expense ratio, or the best ten-year performance. If you want my opinion, I would probably buy Vanguard’s VFH. However, there isn’t a lot of difference between these ETFs. Here are some images from Seeking Alpha for comparison purposes.

What Do We Own?

As noted earlier, I prefer VYM, SCHD, and DGRO. However, the exposure to financials is somewhat limited in these ETFs. VYM has about 19% of its assets in the Financials sector, DGRO is about 18%, and SCHD is about 14.5%.

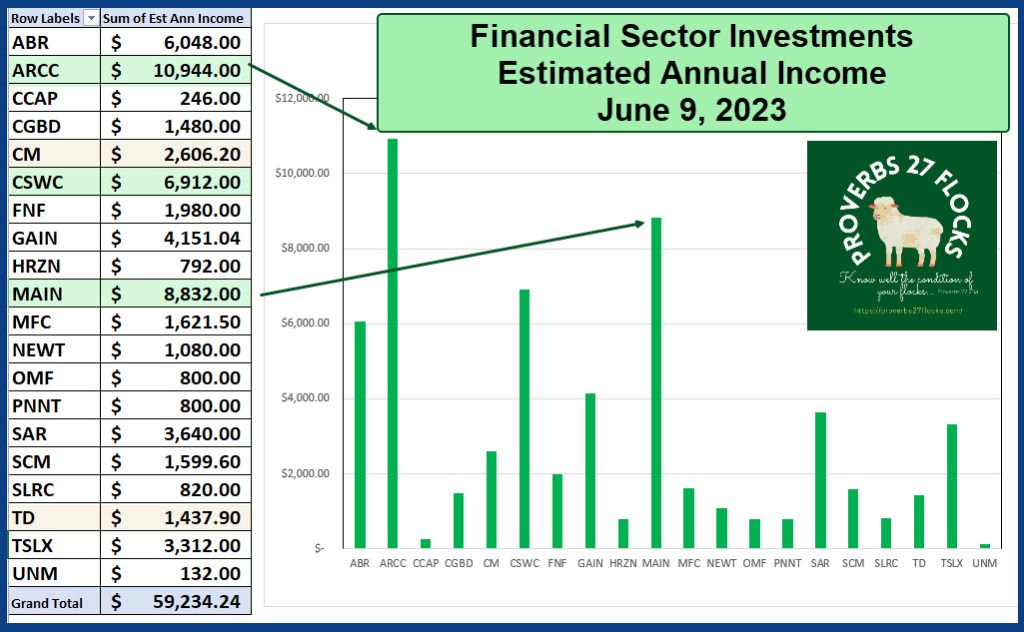

The next two images show you some Excel pivot tables of the Financials in our portfolio. As you can see (by total value), ARCC and MAIN are the largest investments. It isn’t surprising then, that they also provide a bulk of the estimated annual income. Almost $20K comes from these two investments alone. However, I would caution you that many of these investments are BDCs. Don’t buy them if you don’t understand Business Development Companies.

Fidelity Article About the Power of Dividends

Fidelity has a helpful article about the importance of and power of dividends. Click this link if you want to understand this important piece of investing during times of inflation. THE POWER OF DIVIDENDS NOW.

Full Disclosure

Cindie and I do not own any shares of VFH, FNCL, or IYF. I’d rather pick the financial stocks I want. For example, we own shares in two Canadian banks – CM and TD.