Why Dividend Reminders Can Be Helpful

Do you give yourself reminders? I suspect that you do. My wife and I need reminders all the time. For example, we use a calendar app called Cozi. We like it because we are often scheduling different events and things that we need to do by a certain date and time. I have reminders for when I am preaching, when I am teaching, the due date for our Fidelity VISA credit card payment, the birthdays of family members, and vacation dates.

It doesn’t stop there. I have notes on my desk to remind me about some investment tasks I want to complete today. Sometimes I forget when certain foods expire in the refrigerator, so I keep a notepad in the kitchen to remind me of what meats are available, and when they expire. There is also a list of main course items in the freezer.

Dividend reminders can also keep me from being foolish about our investments. When an investment goes down in price, for reasons other than a serious business problem, dividend reminders help me think long-term about the income that investment provides.

One Source for Dividend Reminders

My primary source for reminders is Seeking Alpha. Because I linked our Fidelity accounts to Seeking Alpha, I get email notifications about our holdings. This includes news items, articles created by Seeking Alpha authors, and dividend announcements.

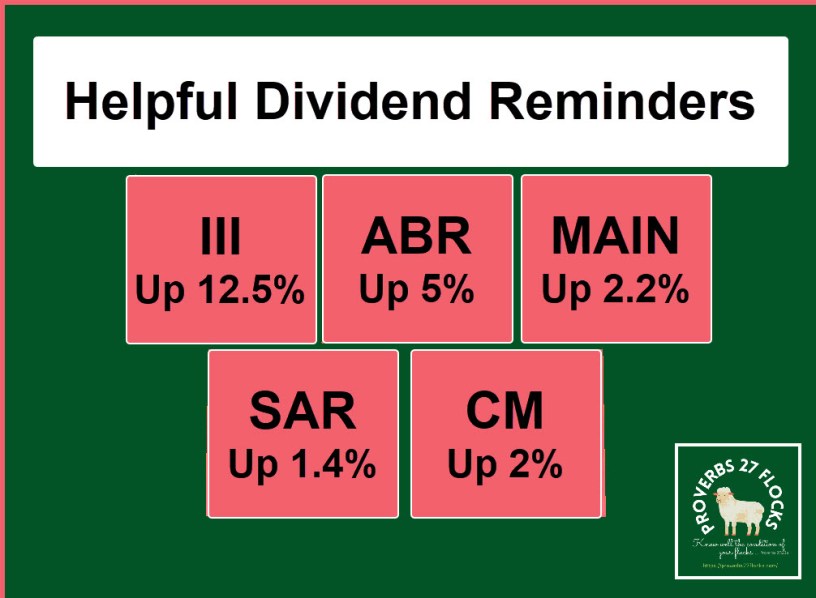

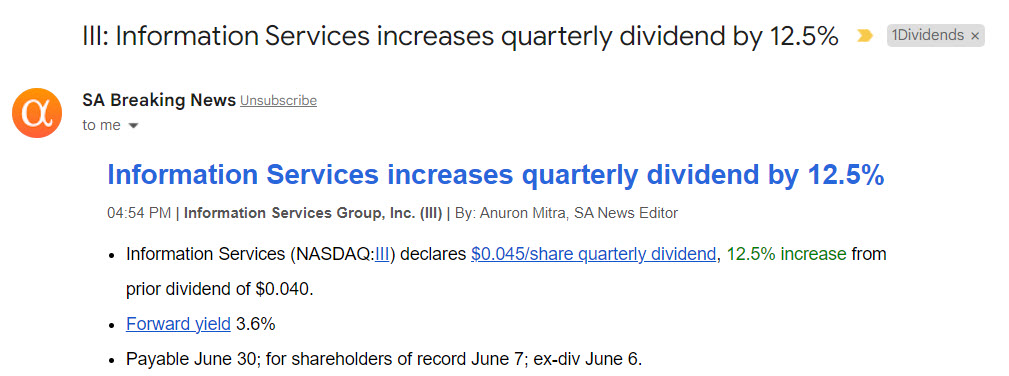

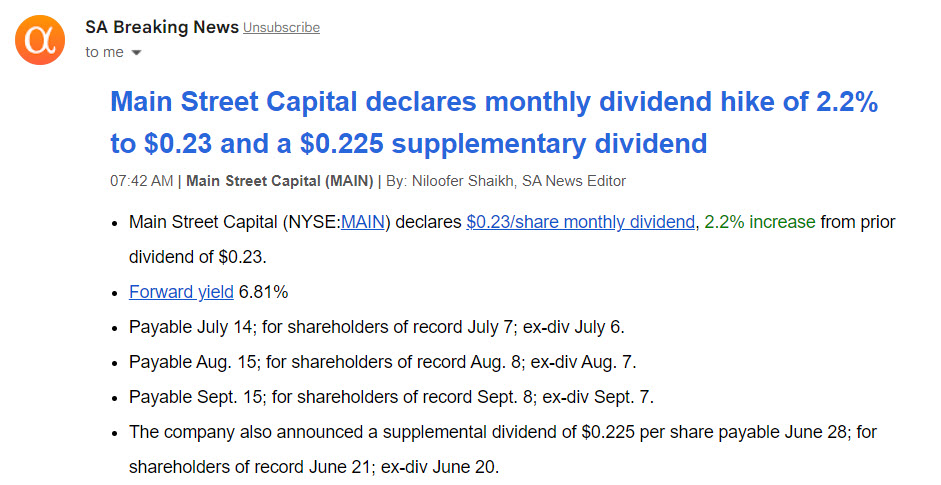

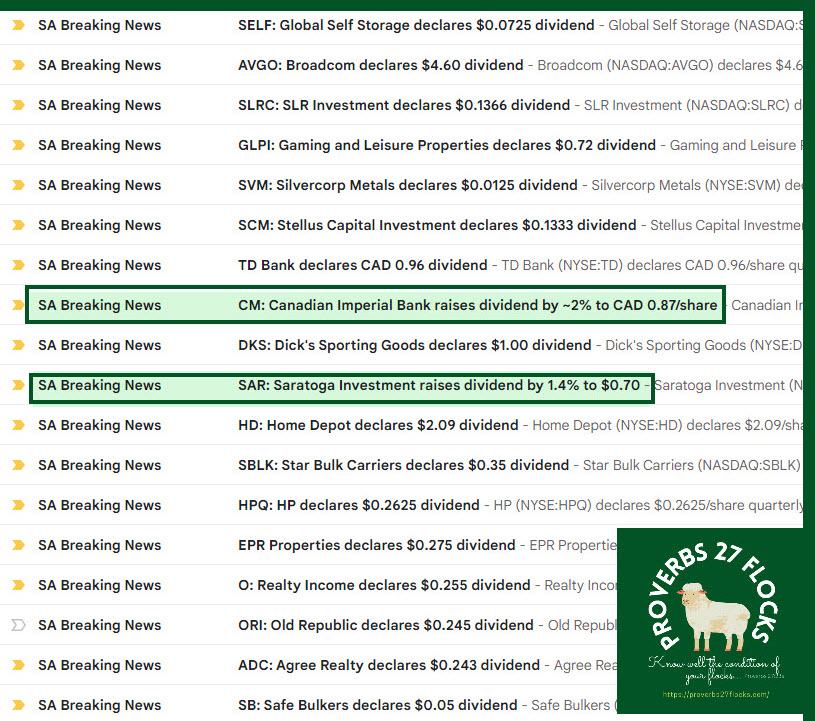

In May, for example, I received 28 reminders of dividends that will be paid, including any that have dividend increases or supplemental dividends. This is a vivid reminder to think long-term. Here are just a couple of the 28.

My Gmail Dividend Folder

The following two images show the email messages I have saved in a folder called “1Dividends.” As you can see, this can be a powerful reminder to ignore most of the fear and trembling in the market.

Another Dividend Reminder Source

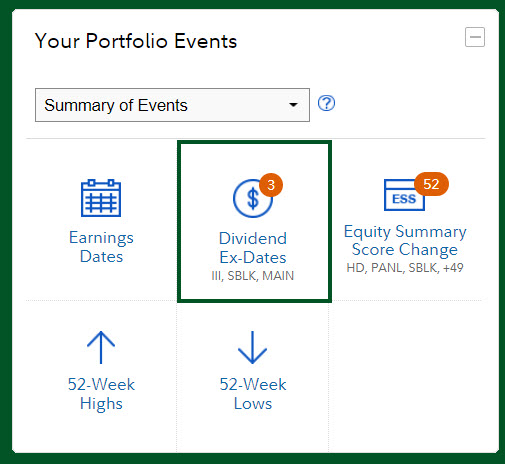

Fidelity Investments also gives me a quick look at stocks that are going Ex-Dividend in the near future. The following image shows what it looks like, followed by three images when you drill into this feature.

Summary

The thinking of the long-term investor needs reminders of the importance of patience when it looks like you have “lost” money on your investments. You only experience a profit or a loss when you sell. Long-term investors think like owners. That means you don’t have to think like a trader and try to time the market. Rather, be patient and let your investments do the work for you.