The Winquist Strategy: Easy and Growing Income

If you had $100 to invest, where would you put the dollars? If you have read a few of my posts, you know I tend to prefer dividend growth ETFs and stocks. That does not mean that there are only dividend-paying stocks in our portfolio, but they are the core holdings. When I sort a download of our Fidelity positions by dividends, 160 of the positions in our eight accounts pay a dividend.

This does not include 32 positions that are options-related. In other words, I currently have 32 options contracts in our positions. Most of those are covered calls. Cindie also owns ten CDs, and those provide interest income. The remaining 33 holdings do not pay a dividend. This includes AMD, ICHR, SAVA, AOSL, ASRT, CCRN, CLF, DBX, FLGT, LTHM, PRPH, PSTG, TITN, & TSLA. To put this in perspective, the non-dividend stocks, in total, are only 13.4% of our total assets. In addition, some of these positions are used for covered call options trades, which creates a “synthetic” dividend. For example, in 2023 YTD, we have earned $10,869.58 trading options on Tesla shares (TSLA).

Which Strategies Are the Best?

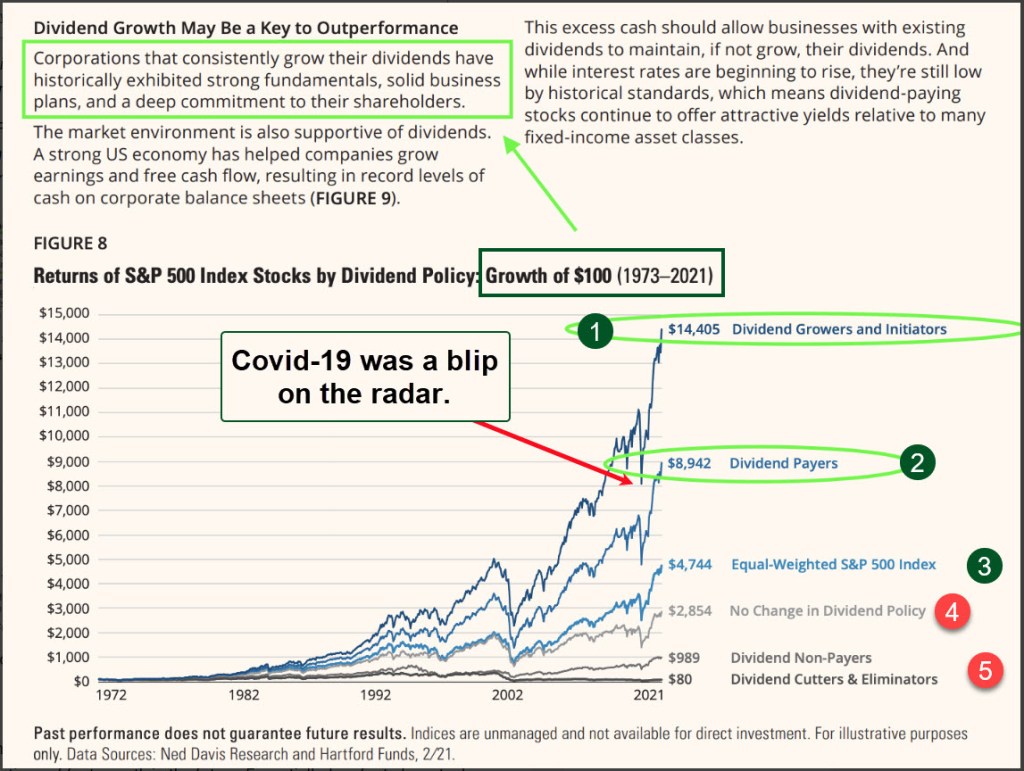

The following graphic is helpful. There are three strategies that have a history of good growth over time. The focus, of course, is only on the S&P 500. You might conclude from this that investing in an ETF or mutual fund that follows the S&P 500 would be the best choice. You would be missing an opportunity if you think that.

By far, the companies that initiated and grew their dividends (1) beat all of the other strategies by a huge margin. Following in the shadow of that strategy is (2) all “dividend payers.” In other words, in both cases dividend-focused investing can be a huge win. Of course, not all dividend investments are good investments. Some REITS and BDCs are good investments, and some are terrible investments.

When you look at number three, “Equal-Weighted S&P 500 Index” (3) do not read that as “S&P 500 index.” The S&P 500 index funds are usually cap-weighted. As a result, you may do really well if the top ten investments do really well, or you might not do so well if the top ten don’t do well. There are some good Equal-Weighted S&P 500 Index ETFs. One is RSP. RSP is “Invesco S&P 500® Equal Weight ETF.”

Which Strategies Will Fail?

Buying investments that don’t have a change in dividend policy is a fruitless pursuit (4). Another disastrous approach is to focus on the wrong non-dividend paying stocks. This doesn’t mean that TSLA is a bad investment, just because it does not currently pay dividends. But be careful when you buy any investment, including ones that do not pay a dividend.

Finally, if you own an investment that pays a dividend, and the company cuts or suspends the dividend, you should seriously consider selling that investment. There are certainly exceptions to that rule of thumb, but it is a good warning flag for asking yourself, “Does this investment still make sense for the long-term?” Never marry and investment and declare “until death I do part.”

Another losing strategy is to panic when the market goes down. Notice the graph for all of these when Covid struck. All of them recovered after Covid was declared non-threatening. In fact, during each bear market, the buy-and-hold investors will generally beat the investors who exit the stock market in fear.

Need Help?

If you need help evaluating your portfolio, I recommend using Seeking Alpha. Or, if you want more help, reach out to me with questions. My advice and ideas are always offered free of charge.

Wayne — Great insight and confirmation for all dividend-oriented investors. Thanks…

>

LikeLiked by 1 person