Are You Getting Your Money’s Worth?

As you head into retirement, don’t forget to include taxes in your budget. This includes, but is not limited to income taxes, property taxes, and sales taxes. This is the portion that is most visible. However, there are other licenses and fees that fly under the radar. These include auto and driver’s licenses, Medicare taxes, Social “Security” taxes, hotel room taxes, bike trail fees, Federal and state gasoline taxes and (sometimes), city and county taxes.

You might be inclined to just ignore these, but that would be to your detriment and disadvantage. While it is somewhat true that the only things that are certain are death and taxes, we can plan for both. Death should be number one on your planning list. Jesus said that there was very little net profit from gaining the whole world and losing your soul. Don’t pass that by without reading John’s gospel or Paul’s book of Romans.

Also, don’t forget that there are other certainties in life. What you sow you will reap. Where your heart is you will store your treasure. Inflation will not go away. Those are just a few of the relative certainties of life.

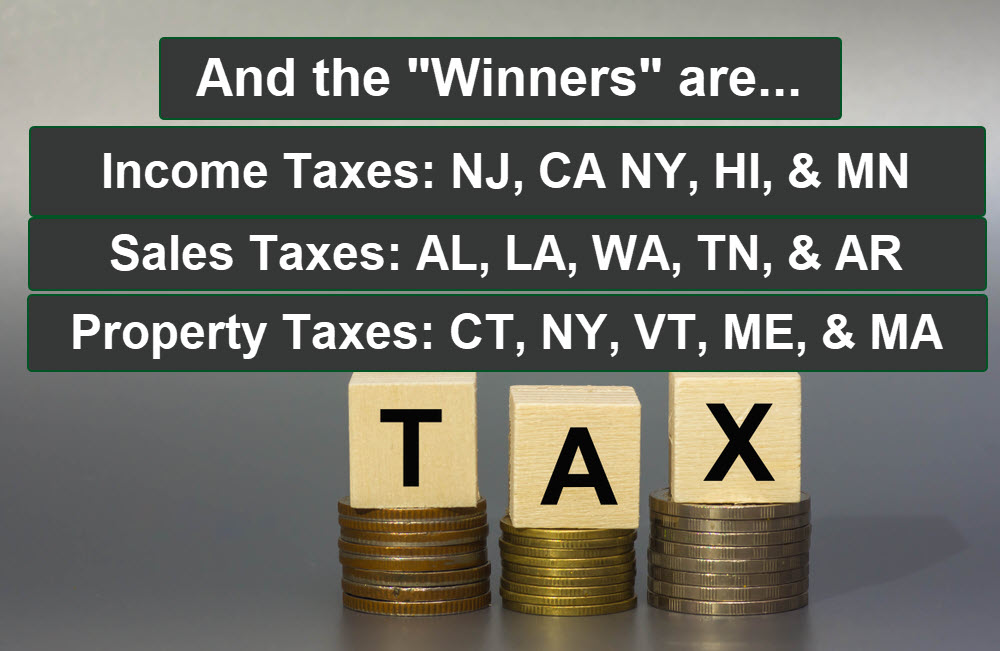

United States Tax Winners

While death should be number one on everyone’s list, taxes may be another certainty you will want to consider. Which states are the “winners” when it comes to property taxes, sales taxes, and income taxes. You probably won’t be surprised to see some states in the list. Bear in mind that these don’t really show the relative total impact in dollars, but they do help you see which states love to get their hands in your wallet.

You might want to visit the Tax Foundation website to learn more: LINK

What Should You Do?

As our nation’s leaders haggle over the national debt, be aware that debt will increase the cost of the interest payments on the debt. This will increase inflation and reduce the value of your dollars. I think every taxpayer should examine their senator’s and legislator’s views on tax policy and the national debt. Those in favor of increasing the debt are really saying that they are in favor of increasing the long-term burden on taxpayers. This may not matter to you, but it will matter to your children and grandchildren.

You may want to conduct a little exercise. Add up all of your purchases and multiply them by the sales tax percentage you pay in your state. Also include your property taxes and the income taxes on your Social Security income, pension(s), earned income, dividends, and capital gains. Then write a letter to your local, state, and Federal representatives and ask them if they might consider alternatives to spending more without a means to pay for more.

Consider moving more of your retirement assets to a ROTH IRA using a IRA-to-ROTH conversion. See me if you have questions about this.