The Easy Way to Start

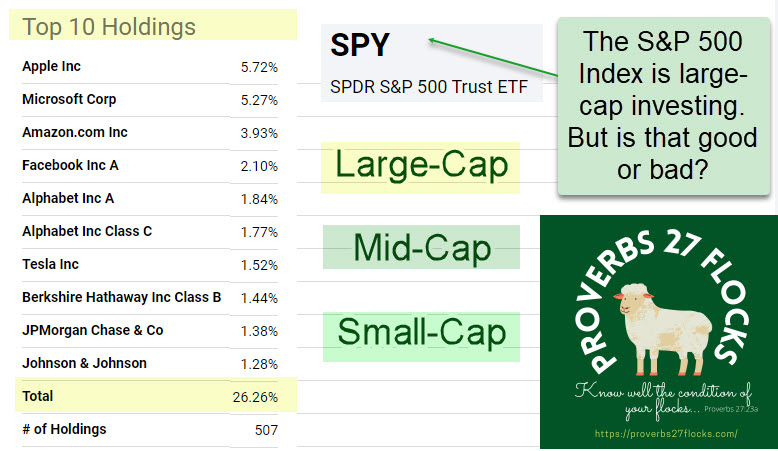

When I am teaching a new investor, I often encourage them to start with a simple approach. The simple approach includes low-costs, diversification, and an index fund that will help them achieve their goals. For example, to invest 50-70% of your assets in an S&P Index mutual fund or ETF is a painless way to get started. One such fund that can accomplish this task is SPY. Two others are VOO and IVV. All three have comparable ten-year performance, dividend yield, and sensible expense ratios less than 0.10%. If I had to pick one, I would probably pick Vanguard’s VOO.

Large-Cap Stocks

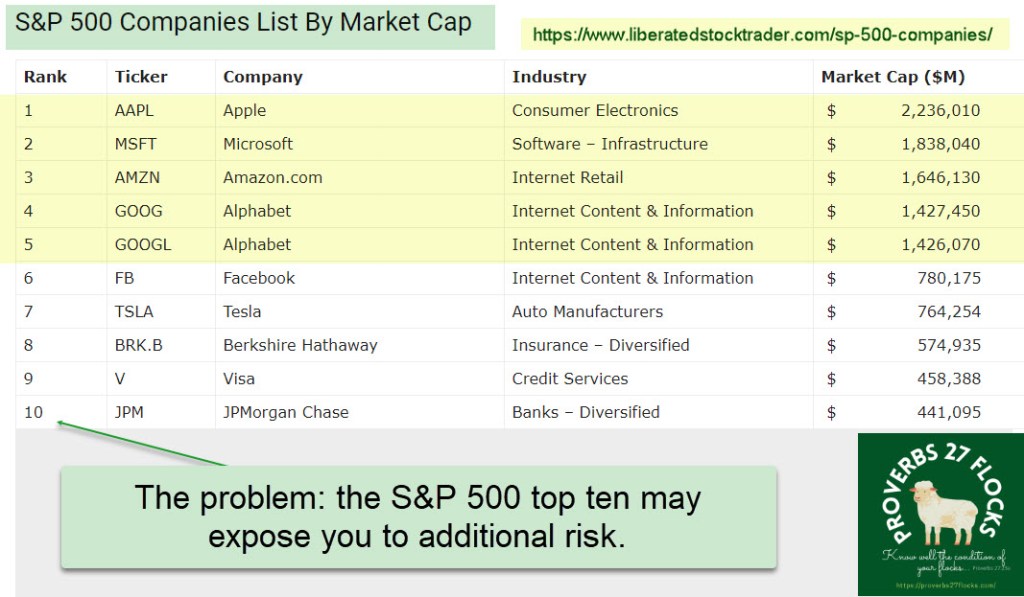

A “large-cap” stock is stock in a company with a huge market capitalization. This is a fancy way of saying that the company is worth many billions of dollars when you multiply the price per share times the number of shares that are in the market. Companies like Microsoft, Apple, Amazon, Tesla and Johnson & Johnson are large-cap companies. Therefore, these companies appear in the top ten of the S&P 500 index. If you own shares of VOO, you own a piece of all of these companies. Unfortunately, this also is a problem. The problem is at least two-fold.

The Problems

The first problem is that the index is cap-weighted. That means the top ten companies make up more than 25% of the total investment dollars. When things are good for these big companies, this is good for the index. But large-cap investments aren’t the only game in town. The second problem is that the index does not include mid-cap or small-cap investments. There are index funds for mid-cap and small-cap stocks, but they aren’t all good ones. There can be a lot of garbage in any of the index funds.

Mid-Cap and Small-Cap Performance

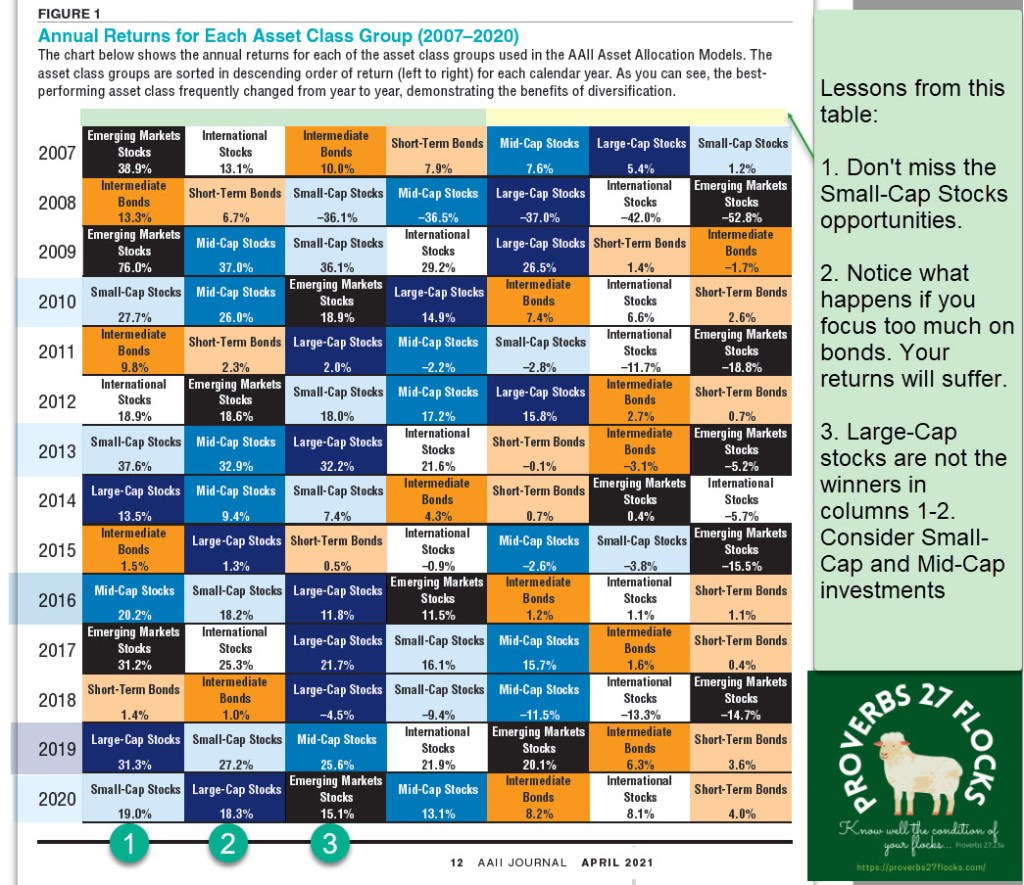

It might surprise you to know that small-cap and mid-cap stocks appear more often, by year, in the top two returns results when compared to large-cap, international stocks, emerging markets, and certainly various bond funds. That is a reason why I buy company stocks for companies in all three cap ranges: large, mid and small. In fact, my investment mix is more geared to mid-cap and small-cap investing than most investors.

This allocation is a conscious decision. There is more investment growth potential in these smaller companies. The following image from the April 2021 AAII Journal is worth reviewing. Notice what appears in the left-most columns. Then notice what appears in the remaining columns. The lesson: You won’t see large-cap shining until column three. The better choices, in columns 1-2 are small-cap and mid-cap.

That isn’t to say that small-caps are always the winners. In 2007, 2011, and 2015 they suffered. When the economy is struggling, investors start to fear small-cap investments. That is a good reason to have a heavier weighting in large cap investments. They can usually weather the difficult times with less volatility.

Full Disclosure

Cindie and I do not own any S&P 500 index funds. Instead, we focus on dividend-growth ETFs like VYM, SCHD, and DGRO.